Helmerich & Payne (HP) Incurs Wider-Than-Expected Q1 Loss

Helmerich & Payne Inc. HP reported fiscal first-quarter 2021 adjusted loss of 82 cents per share, wider than the Zacks Consensus Estimate of 78 cents. In the year-ago period, the oil and gas contract drilling services provider earned 13 cents per share. The underperformance reflects a steep decline in activity.

Meanwhile, operating revenues of $246.4 million topped the Zacks Consensus Estimate of $241 million on better-than-expected results from the key North America Solutions segment. Precisely, sales from the unit totaled $202 million, ahead of the Zacks Consensus Estimates of $185 million. However, revenues decreased 59.9% from the year-ago level.

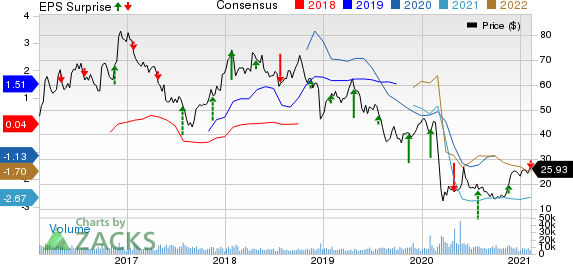

Helmerich & Payne, Inc. Price, Consensus and EPS Surprise

Helmerich & Payne, Inc. price-consensus-eps-surprise-chart | Helmerich & Payne, Inc. Quote

Segmental Performance

North America Solutions: During the quarter, operating revenues of $202 million were down 61.5% year over year on lower activity levels, with the average number of active rigs falling from 192 to 81. The steep activity declines meant that the segment swung to an operating loss of $72.9 million from a profit of $52.1 million in fiscal first-quarter 2020.

Offshore Gulf of Mexico: Revenues of $32.3 million decreased 19.8% from the year-ago quarter due to lower activity and pricing. This also resulted in the segment’s operating profit to fall 56.7% from the prior-year period to $2.7 million.

International Solutions: The segment’s operations generated revenues of $10.5 million, down from $46.5 million in the prior-year quarter – again due to weak activity levels, with the average number of active rigs falling from 18 to 4. The unit reported a loss of $8.4 million against income of $3.1 million in the corresponding period a year ago.

Capital Expenditure & Balance Sheet

In the reported quarter, Helmerich & Payne spent $14 million on capital programs. As of Dec 31, 2020, the company had $374 million in cash and cash equivalents while long-term debt was $481.2 million (debt-to-capitalization of 13%).

Guidance

This Tulsa, OK-based company anticipates operating gross margins in the North America Solutions segment between $60 million and $70 million in the fiscal second quarter. The company sees around 105-110 contracted rigs by Mar 31, 2021.

Coming to the Offshore Gulf of Mexico segment, Helmerich & Payne envisions operating gross margins within $6-$9 million for the fiscal second quarter.

Additionally, International Solutions operating gross margins are forecast at a loss of $1-$3 million for the current quarter.

For the current fiscal year, Helmerich & Payne estimates capital outlay within $85-$105 million.

Zacks Rank & Stock Picks

Helmerich & Payne carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are PDC Energy PDCE, Royal Dutch Shell RDS.A and Pioneer Natural Resources Company PXD. Each of the companies sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

PDC Energy has an expected earnings growth rate of 165.91% for the current year.

Royal Dutch Shell has an expected earnings growth rate of 166.94% for the current year.

Pioneer Natural Resources has an expected earnings growth rate of 331.93% for the current year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research