Helmerich & Payne (HP) Stock Up 10.2% on Improved Q2 Loss

Shares of Helmerich & Payne Inc. HP have gained 10.2% since second-quarter fiscal 2021 earnings announcement on Apr 30. The bright spot in this industry player's earnings performance, which saw a higher-than-estimated top line and a narrower loss, is its cost-saving efforts and a strict expense management that boosted investor confidence.

Delving Deeper

Helmerich & Payne reported an adjusted loss of 60 cents per share for the fiscal second quarter, narrower than the Zacks Consensus Estimate of a loss of 62 cents, attributable to a strong operating profit from the offshore Gulf of Mexico segment.

However, in the year-ago period, the oil and gas contract drilling services provider incurred a loss of a cent per share. This underperformance reflects weak revenue contribution from all the three segments.

Nevertheless, operating revenues of $296 million topped the Zacks Consensus Estimate of $292 million but the top line decreased 53.3% from the year-ago level.

Segmental Performance

North America Solutions: During the quarter, operating revenues of $250 million were down 54.2% year over year. However, the segment reported a narrower operating loss of $109.8 million than the loss of $342.7 million reported in second-quarter fiscal 2020, attributable to higher rig activity levels.

Offshore Gulf of Mexico: Revenues of $29.3 million decreased 11.5% from the year-ago quarter due to unexpected downtime on a rig. The segment recorded an operating profit of $2.98 million against the year-ago loss of $3.32 million.

International Solutions: The segment’s operations generated revenues of $14.8 million, down from $51.3 million in the prior-year quarter. The unit reported a loss of $3.5 million, narrower than the year-ago loss of $152.5 million as it gained from extra revenue days and $1.9 million worth of revenue reimbursements.

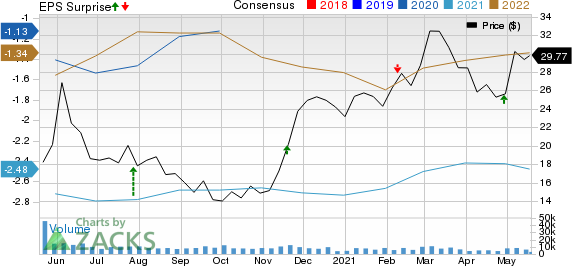

Helmerich & Payne, Inc. Price, Consensus and EPS Surprise

Helmerich & Payne, Inc. price-consensus-eps-surprise-chart | Helmerich & Payne, Inc. Quote

Capital Expenditure & Balance Sheet

In the reported quarter, Helmerich & Payne spent $16.8 million on capital programs. As of Mar 31, 2021, the company had $427.2 million in cash and cash equivalents while long-term debt was $481.6 million (debt-to-capitalization of 13.5%).

Guidance

This Tulsa, OK-based company anticipates operating gross margins between $65 million and $75 million in the North America Solutions segment for the fiscal third quarter. The company predicts around 120-125 contracted rigs by Mar 31, 2021.

Coming to the Offshore Gulf of Mexico segment, Helmerich & Payne envisions operating gross margins within $6-$9 million for the fiscal third quarter.

Additionally, International Solutions operating gross margins are forecast at a loss of $1-$3 million for the current quarter.

For the current fiscal year, Helmerich & Payne estimates capital outlay within $85-$105 million.

Research and development expenses for fiscal 2021 are now expected to be roughly $25 million while general and administrative expenses are projected to be approximately $160 million. Depreciation is estimated to be around $425 million.

Zacks Rank & Key Picks

Helmerich & Payne currently carries a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Silver Bow Resources Inc. SBOW, Matador Resources Company MTDR and Continental Resources, Inc. CLR, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

SilverBow Resources Inc. (SBOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research