Helmerich & Payne Posts Gains Despite Slowing Oil Industry

It's fair to say that expectations for oil-rig owner Helmerich & Payne (NYSE: HP) were pretty low coming into its fiscal first quarter. Oil prices dropped precipitously at the end of 2018, and most oil services companies reported significant revenue declines in North America.

Surprisingly, though, Helmerich & Payne posted higher revenue in the face of a challenging backdrop and reported better-than-expected earnings. Let's take a look at the company's most recent results, how it was able to grow in the midst of a slowdown in oil-service activity, and whether these gains were encouraging enough to ease concerns that its dividend may be in trouble.

Image source: Getty Images.

By the numbers

Metric | Q1 2019 | Q4 2018 | Q1 2018 |

|---|---|---|---|

Revenue | $740.5 million | $696.8 million | $564.1 million |

Operating income | $54.2 million | $23.1 million | $500.1 million |

EPS (diluted) | $0.17 | $0.02 | $4.57 |

Free cash flow | $22.8 million | $86.1 million | ($49.2 million) |

DATA SOURCE: HELMERICH & PAYNE EARNINGS RELEASE. EPS = EARNINGS PER SHARE.

This quarter was a stark improvement from prior quarters. While the $0.17-per-share earnings number is much better than the prior quarter's, it does include some one-time charges that impacted the bottom line. Management noted that adjusting for all one-time gains and losses, EPS was $0.42.

Considering all the dour reports coming from North American oil services companies, Helmerich & Payne's revenue gains and substantial operating income gain, specifically in the U.S. Land segment, were a pleasant surprise. The reason that drilling wasn't as impacted as other parts of the oil services business is that most of the company's rigs are signed to long-term contracts with producers, and the actual drilling aspect of an oil well is less expensive than the hydraulic fracturing and completion portion.

So over the past quarter, most producers elected to keep their drilling rigs under contract busy by drilling wells, but not actually completing them. As a result, the inventory of drilled but uncompleted wells stands at a record high of 8,600.

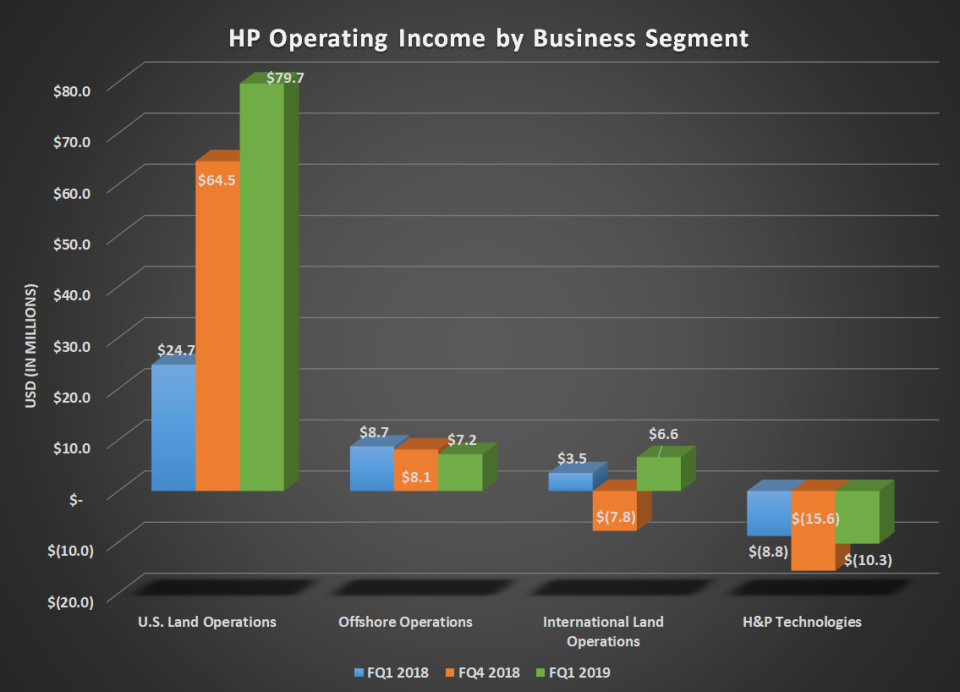

Data source: Helmerich & Payne. Chart by author.

Granted, the company's cash flow results didn't quite deliver, but capital expenditures were much higher than this time last year, as the company continued to invest heavily in upgrades for its existing fleet. Considering that it has a 98% utilization rate for its highest-specification rigs compared to a fleetwide average of 68%, that has been worth the effort. What's more, these super-spec rigs are one of the few parts of the oil services business that has been able to increase pricing in recent quarters, which has helped profitability.

What management had to say

As good as this quarter was, management doesn't think that it is completely immune to the recent decline in activity across North America. Many producers have pulled back on their spending plans for 2019 because they have no idea where oil prices are headed and don't want to risk spending too much if oil prices remain low.

Concurrently, Helmerich & Payne is responding with capital-expenditure cuts of its own. Here's CFO Mark Smith in a press release explaining the rationale behind the capital spending cuts:

This recent lack of clear direction in crude prices is injecting an amount of uncertainty into some of our customers' drilling plans for 2019. H&P, like our customers, has responded accordingly. H&P is slowing the cadence of super-spec upgrades creating a commensurate reduction in our planned capital expenditures for the year.

We have reduced our budgeted capex by over 20%, approximately $150 million from our initial budget. As in the past with volatile markets, the Company will maintain a disciplined capital allocation strategy and we remain confident that our operational results and financial strength will support that strategy.

For more, here's a full transcript of Helmerich & Payne's conference call.

The dividend is in better shape, but H&P isn't out of the woods yet

Helmerich & Payne has done a fantastic job over the years rewarding shareholders with consistently growing dividends. A combination of an incredibly strong balance sheet and a fleet of higher-specification rigs has allowed the company to command price and take market share, as demand for rigs to handle complex jobs for shale has skyrocketed in recent years.

These past couple of quarters are the first time in a while that the company's dividend actually looks at risk. Its cash pile has been dwindling for some time, and spending to upgrade its fleet has eaten up much of its operating cash flow. In the prior quarter, the company even made some interesting moves that hinted at an asset sale.

Cutting capex should certainly help free up some cash. Helmerich & Payne now expects to spend $500 million to $530 million in fiscal 2019. Considering it spent close to $200 million this quarter alone, it's fair to say free cash flow will look much better in the coming quarters. Whether that will be enough to meet all its dividend payments remains to be seen, though, so investors should continue to watch how the drilling market progresses this year.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.