Here's How Target (TGT) is Placed Ahead of Q3 Earnings

Target Corporation TGT is likely to register an increase in the top line when it reports third-quarter fiscal 2021 results on Nov 17, before the opening bell. The Zacks Consensus Estimate for revenues is pegged at $24,533 million, indicating growth of 8.4% from the prior-year reported figure.

The bottom line of this general merchandise retailer is anticipated to increase year over year. We note that the Zacks Consensus Estimate for earnings per share for the quarter under review has risen 1.1% to $2.81 in the past seven days. The figure suggests an increase of couple of cents from the year-ago period.

Target has a trailing four-quarter earnings surprise of 36.7%, on average. In the last reported quarter, this Minneapolis, MN-based company surpassed the Zacks Consensus Estimate by 4.6%.

Key Factors to Note

Target’s robust product assortments across a wide range of categories, prudent store offerings and growing omni-channel retailing capacity are likely to have aided the retailer rake in robust traffic, and thus higher revenues.

Thanks to its one-stop shopping destination, customers have been opting for Target owing to its multi-category assortment of owned and exclusive brands as well as popular national brands. The company, which is among the biggest winners amid the pandemic, has been deploying resources to enhance omni-channel capacities, including same-day delivery of in-store purchases and fast tracking technology improvements. Clearly, these are likely to have favorably impacted the company’s second-quarter performance.

The company’s commitment to offer a unique shopping experience with safe and convenient options including contactless Drive Up and Order Pickup, and same-day delivery with Shipt are worth mentioning. Customers have been responding positively to such shopping tools. Markedly, it has been ramping up store openings and remodels, scaling up fulfillment services and enhancing supply chain capabilities. On its last earnings call, Target projected high-single digit growth in comparable sales for the second half of fiscal 2021.

Clearly, aforementioned factors instill optimism regarding the outcome of the results. However, margins still remain an area to watch. Impact of costs associated with digital fulfilment, supply chain and COVID-19 related expenses cannot be ruled out. We note that higher merchandise and freight costs did hurt the gross margin in the last reported quarter. Also, costs related to additional employee payments and benefits, and investments undertaken to preserve safety and health of customers and team members amid the coronavirus crisis may have weighed on margins in the quarter to be reported.

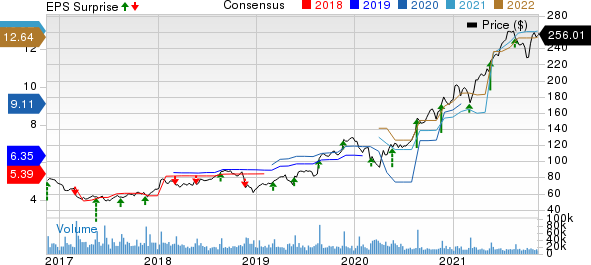

Target Corporation Price, Consensus and EPS Surprise

Target Corporation price-consensus-eps-surprise-chart | Target Corporation Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Target this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Although Target carries a Zacks Rank #3, its Earnings ESP of -0.96% makes surprise prediction difficult.

Stocks With a Favorable Combination

Here are a few companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Home Depot HD currently has an Earnings ESP of +4.59% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up 1.5% in the past seven days to $3.38 per share, suggesting growth of 6.3% from the year-ago quarter’s reported number.

Home Depot’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $34.77 billion, which indicates an improvement of 3.7% from the prior-year quarter. HD has a trailing four-quarter earnings surprise of 9.2%, on average.

Lowe's Companies LOW currently has an Earnings ESP of +14.12% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up 1.3% in the last seven days to $2.30 per share, suggesting a 16.2% increase from the year-ago reported number.

However, Lowe’s top line is expected to decline year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $21.68 billion, which suggests a decline of 2.8% from the prior-year quarter. LOW has a trailing four-quarter earnings surprise of 10.1%, on average.

Macy's M currently has an Earnings ESP of +9.80% and a Zacks Rank #2. The company is likely to register bottom-line improvement when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up 11.5% in the last seven days to 29 cents per share, suggesting a substantial improvement from a loss of 19 cents a share reported in the year-ago quarter.

Macy's top line is also expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $5.22 billion, which indicates an improvement of 30.9% from the figure reported in the prior-year quarter. M has a trailing four-quarter earnings surprise of 269.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research