Here's What We Think About Emeco Holdings' (ASX:EHL) CEO Pay

This article will reflect on the compensation paid to Ian Testrow who has served as CEO of Emeco Holdings Limited (ASX:EHL) since 2015. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Emeco Holdings

Comparing Emeco Holdings Limited's CEO Compensation With the industry

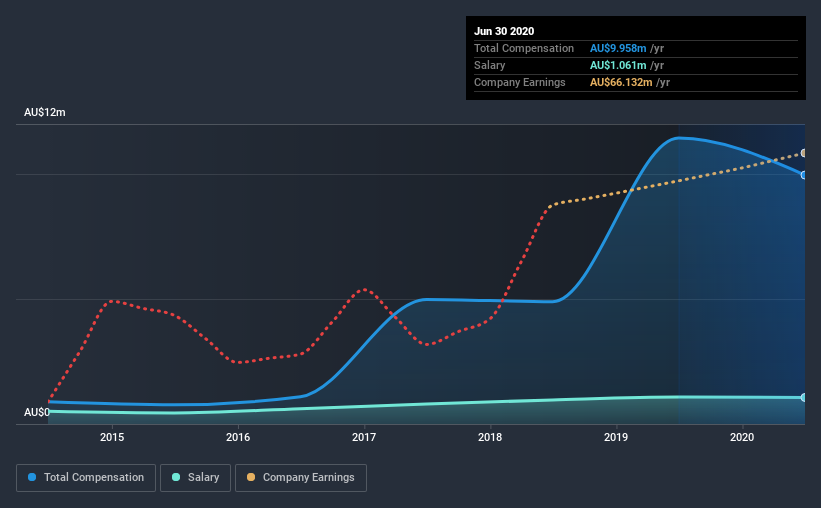

Our data indicates that Emeco Holdings Limited has a market capitalization of AU$526m, and total annual CEO compensation was reported as AU$10.0m for the year to June 2020. That's a notable decrease of 13% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$1.1m.

In comparison with other companies in the industry with market capitalizations ranging from AU$273m to AU$1.1b, the reported median CEO total compensation was AU$1.3m. Accordingly, our analysis reveals that Emeco Holdings Limited pays Ian Testrow north of the industry median. Moreover, Ian Testrow also holds AU$11m worth of Emeco Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$1.1m | AU$1.1m | 11% |

Other | AU$8.9m | AU$10m | 89% |

Total Compensation | AU$10.0m | AU$11m | 100% |

Speaking on an industry level, nearly 66% of total compensation represents salary, while the remainder of 34% is other remuneration. In Emeco Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Emeco Holdings Limited's Growth

Over the past three years, Emeco Holdings Limited has seen its earnings per share (EPS) grow by 135% per year. In the last year, its revenue is up 16%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Emeco Holdings Limited Been A Good Investment?

Given the total shareholder loss of 56% over three years, many shareholders in Emeco Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Emeco Holdings pays its CEO higher than the norm for similar-sized companies belonging to the same industry. But the company has impressed with its EPS growth, but it's disappointing to see negative shareholder returns over the same period. Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Emeco Holdings that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.