Here's What's Concerning About Ovato (ASX:OVT)

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. And from a first read, things don't look too good at Ovato (ASX:OVT), so let's see why.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Ovato:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.024 = AU$6.3m ÷ (AU$470m - AU$201m) (Based on the trailing twelve months to December 2019).

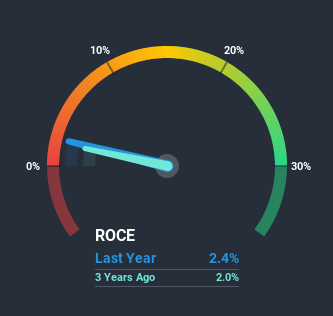

Thus, Ovato has an ROCE of 2.4%. Ultimately, that's a low return and it under-performs the Commercial Services industry average of 12%.

Check out our latest analysis for Ovato

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Ovato's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Ovato Tell Us?

We aren't too thrilled by the trend because ROCE has declined 66% over the last five years and despite the capital raising conducted before the latest reports, the business has -23% less capital employed.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 43%, which has impacted the ROCE. Without this increase, it's likely that ROCE would be even lower than 2.4%. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

The Key Takeaway

To see Ovato reducing the capital employed in the business in tandem with diminishing returns, is concerning. Unsurprisingly then, the stock has dived 98% over the last five years, so investors are recognizing these changes and don't like the company's prospects. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One final note, you should learn about the 4 warning signs we've spotted with Ovato (including 3 which is shouldn't be ignored) .

While Ovato isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.