Here's Why You Should Buy PPG Industries (PPG) Stock Right Now

PPG Industries Inc.’s PPG stock looks promising at the moment. The company’s shares have popped 20% over the past three months. It is gaining from its restructuring initiatives, cost-management actions and strategic acquisitions.

We are positive on the company’s prospects and believe that the time is right for you to add the stock to the portfolio as it looks promising and is poised to carry the momentum ahead.

PPG Industries currently has a Zacks Rank #2 (Buy) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities for investors.

Let’s delve deeper into the factors that make this paints giant an attractive choice for investors right now.

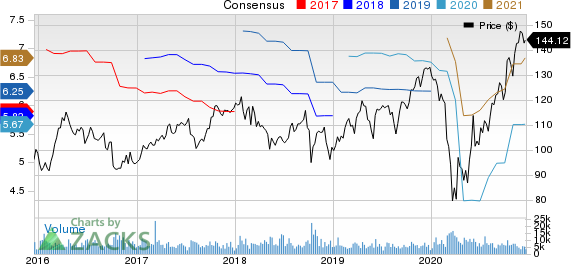

Price Performance

Shares of PPG Industries have rallied 39% over the past six months against the 30% rise of its industry. It has also outperformed the S&P 500’s roughly 19.6% rise over the same period.

Estimates Going Up

Over the past two months, the Zacks Consensus Estimate for PPG Industries for the current year has increased around 4.8%. The consensus estimate for 2021 has also been revised 5.7% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

Cash Deployment

PPG Industries remains committed to boost returns to shareholders leveraging strong cash flows. In July 2020, it raised its quarterly dividend by 6% to 54 cents per share. Notably, PPG Industries has raised its annual dividend payout for 49th straight year. It also generated more than $800 million of cash from operations during the third quarter.

Cost Actions to Drive Margins

The company is actively managing costs amid a challenging environment due to the coronavirus pandemic. In the third quarter, it delivered more than $35 million of incremental structural savings from business restructuring programs and around $90 million of cost savings from various interim initiatives. PPG Industries expects to achieve restructuring savings of $30-$35 million in the fourth quarter.

Acquisitions to Boost Top Line

PPG Industries is taking steps to grow business inorganically through strategic acquisitions. The acquisition of specialty materials maker, Dexmet Corporation, has allowed the company to add value to its customers by enhancing product offerings as well as expanding R&D capabilities. The purchase of Industria Chimica Reggiana also complements the company’s current product offerings for the automotive refinish and light industrial coatings industries. Earlier this year, the company also closed the acquisition of Alpha Coating Technologies.

The company also recently agreed to acquire Ennis-Flint, a global manufacturer of coatings. This acquisition will help PPG Industries expand its product portfolio and broaden opportunities in rapidly developing and high-growth mobility technology solutions. Acquisitions are expected to contribute to the company’s top line this year.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Bunge Limited BG, Impala Platinum Holdings Limited IMPUY and BHP Group BHP.

Bunge has an expected earnings growth rate of 43.5% for the current year. The company’s shares have gained around 14% in the past year. It currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Impala Platinum has an expected earnings growth rate of 131.7% for the current fiscal. The company’s shares have rallied around 37% in the past year. It currently carries a Zacks Rank #1.

BHP Group has a projected earnings growth rate of 32.4% for the current fiscal year. The company’s shares have gained around 21% in a year. It currently carries a Zacks Rank #1.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

BHP Group Limited (BHP) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Bunge Limited (BG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research