Here's Why Coffee Holding (NASDAQ:JVA) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Coffee Holding Co., Inc. (NASDAQ:JVA) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Coffee Holding

How Much Debt Does Coffee Holding Carry?

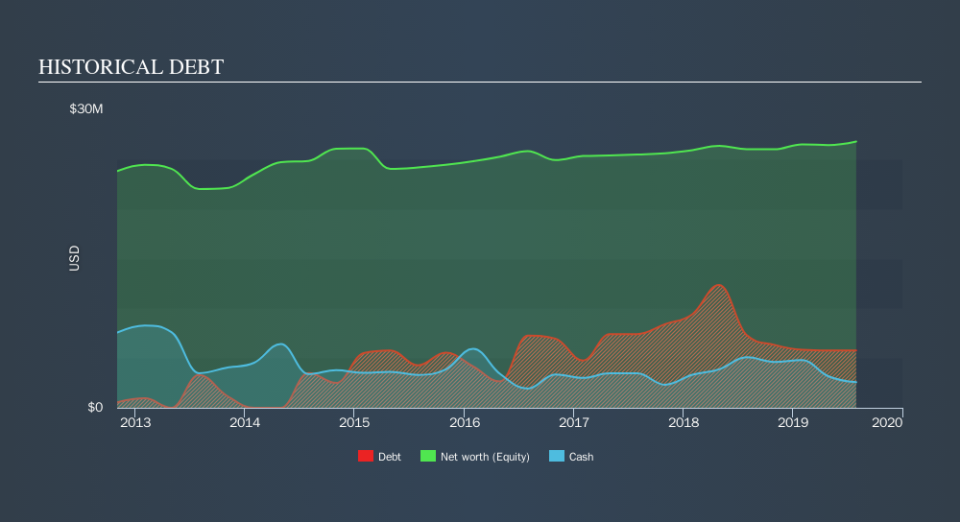

As you can see below, Coffee Holding had US$5.77m of debt at July 2019, down from US$7.30m a year prior. However, it also had US$2.57m in cash, and so its net debt is US$3.20m.

How Healthy Is Coffee Holding's Balance Sheet?

According to the last reported balance sheet, Coffee Holding had liabilities of US$9.49m due within 12 months, and liabilities of US$1.49m due beyond 12 months. Offsetting these obligations, it had cash of US$2.57m as well as receivables valued at US$8.49m due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Coffee Holding's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$21.6m company is struggling for cash, we still think it's worth monitoring its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Coffee Holding's net debt is sitting at a very reasonable 1.6 times its EBITDA, while its EBIT covered its interest expense just 4.5 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Shareholders should be aware that Coffee Holding's EBIT was down 49% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Coffee Holding can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Coffee Holding actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Coffee Holding's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better In particular, we are dazzled with its conversion of EBIT to free cash flow. Considering this range of data points, we think Coffee Holding is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Over time, share prices tend to follow earnings per share, so if you're interested in Coffee Holding, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.