Here's Why Equity LifeStyle Properties, Inc.'s (NYSE:ELS) CEO Might See A Pay Rise Soon

The decent performance at Equity LifeStyle Properties, Inc. (NYSE:ELS) recently will please most shareholders as they go into the AGM coming up on 27 April 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Equity LifeStyle Properties

How Does Total Compensation For Marguerite Nader Compare With Other Companies In The Industry?

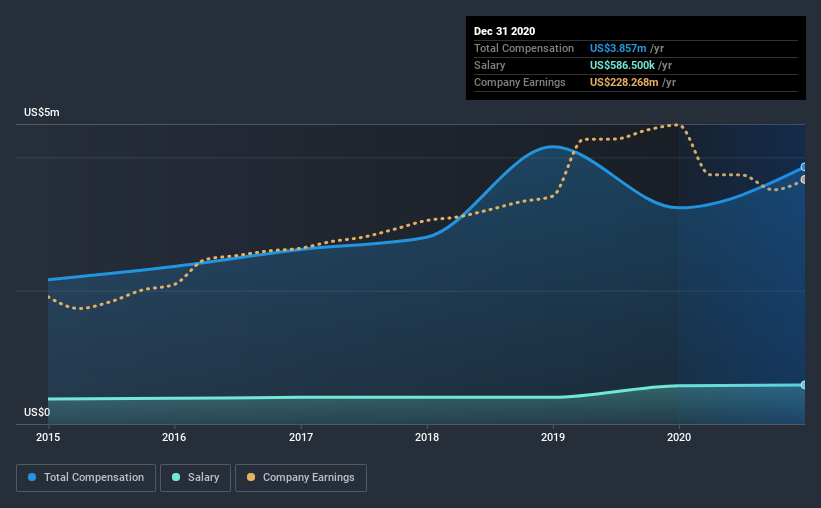

Our data indicates that Equity LifeStyle Properties, Inc. has a market capitalization of US$13b, and total annual CEO compensation was reported as US$3.9m for the year to December 2020. Notably, that's an increase of 19% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$587k.

For comparison, other companies in the industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$7.3m. That is to say, Marguerite Nader is paid under the industry median. Moreover, Marguerite Nader also holds US$17m worth of Equity LifeStyle Properties stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$587k | US$575k | 15% |

Other | US$3.3m | US$2.7m | 85% |

Total Compensation | US$3.9m | US$3.2m | 100% |

Talking in terms of the industry, salary represented approximately 15% of total compensation out of all the companies we analyzed, while other remuneration made up 85% of the pie. There isn't a significant difference between Equity LifeStyle Properties and the broader market, in terms of salary allocation in the overall compensation package. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Equity LifeStyle Properties, Inc.'s Growth

Equity LifeStyle Properties, Inc.'s funds from operations (FFO) grew 7.2% per yearover the last three years. Its revenue is up 4.8% over the last year.

We'd prefer higher revenue growth, but we're happy with the modest FFO growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Equity LifeStyle Properties, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Equity LifeStyle Properties, Inc. for providing a total return of 67% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Equity LifeStyle Properties (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.