Here's Why Granite Oil (TSE:GXO) Is Weighed Down By Its Debt Load

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Granite Oil Corp. (TSE:GXO) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Granite Oil

What Is Granite Oil's Net Debt?

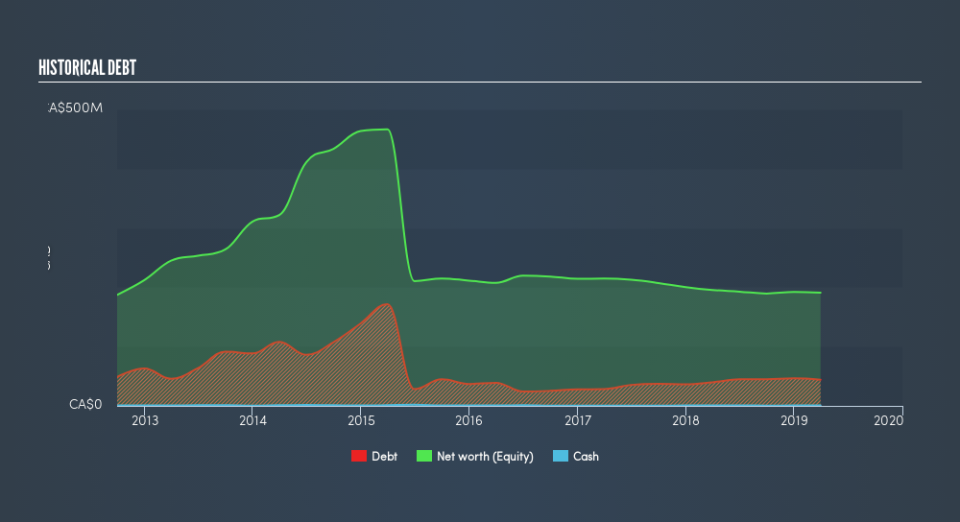

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Granite Oil had CA$44.2m of debt, an increase on CA$39.7m, over one year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Granite Oil's Balance Sheet?

The latest balance sheet data shows that Granite Oil had liabilities of CA$49.5m due within a year, and liabilities of CA$33.6m falling due after that. On the other hand, it had cash of CA$849.0k and CA$4.88m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$77.4m.

The deficiency here weighs heavily on the CA$26.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Granite Oil would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Granite Oil has a quite reasonable net debt to EBITDA multiple of 2.3, its interest cover seems weak, at 2.3. The main reason for this is that it has such high depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. In any case, it's safe to say the company has meaningful debt. Notably, Granite Oil made a loss at the EBIT level, last year, but improved that to positive EBIT of CA$6.2m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Granite Oil's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Granite Oil reported free cash flow worth 19% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Granite Oil's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least its EBIT growth rate is not so bad. Overall, it seems to us that Granite Oil's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Given our concerns about Granite Oil's debt levels, it seems only prudent to check if insiders have been ditching the stock.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.