Here's Why You Should Hold ICF International (ICFI) Stock Now

ICF International, Inc. ICFI has a strong global presence in diverse markets and its robust, long-term relationships with clients should continue to drive sales.

ICF’s 2023 earnings and revenues are expected to improve 2% and 10.7%, respectively, year over year.

Tailwinds

Increased government focus on environmental initiatives, efficiency and mission performance management, transparency and accountability, and heightened demand for integrating domain knowledge of client missions and programs with innovative technology-enabled solutions is driving demand for ICF’s advisory services.

The company is seeing a significant increase in revenues from its high-growth markets, which include IT modernization/digital transformation, public health, disaster management, utility consulting, climate, environment and infrastructure services. A 1.31 trailing 12-month book-to-bill ratio and a $9 billion new business pipeline at the end of the third quarter of 2022 provide good revenue visibility for the near term.

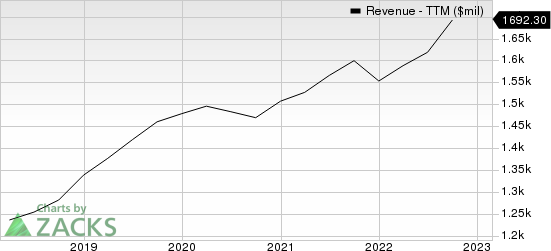

ICF International, Inc. Revenue (TTM)

ICF International, Inc. revenue-ttm | ICF International, Inc. Quote

Strategic acquisitions have helped to reduce the company’s dependency on government spending. In addition, the acquisitions have expanded its offerings and provided scale in certain geographies. Past and future acquisitions are also expected to contribute to the growth of ICF’s EBITDA and free cash flow.

Some Risks

ICF is seeing an escalation in costs as it is making significant investments in internal infrastructure and acquisitions. The company’s operating costs and expenses increased 3.9% in 2021. These expenses rose 5.1% year over year in 2020 and 9.2% in 2019.

Zacks Rank and Stocks to Consider

ICF currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Business Services sector are Trane Technologies TT and The Interpublic Group of Companies, Inc. IPG.

Trane Technologies sports a Zacks Rank #1 at present. TT has a long-term earnings growth expectation of 9.8%.

Trane delivered a trailing four-quarter earnings surprise of 8.2% on average.

Interpublic currently sports a Zacks Rank #1. IPG has a long-term earnings growth expectation of 4.61%.

IPG delivered a trailing four-quarter earnings surprise of 8.2% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report