Here's Why Hold Strategy is Apt for Broadridge (BR) Stock

Broadridge Financial Solutions, Inc. BR is currently riding on a strong recurring revenue position and the Itiviti acquisition, which are helping it to grow internationally.

The company’s earnings for fiscal 2023 and 2024 are expected to improve 7.6% and 9.1%, respectively, year over year. Revenues are expected to increase 6.9% in fiscal 2023 and 5.1% in fiscal 2024.

Factors That Augur Well

Fundamental trends like growing demand for data and analytics, mutualization and digitization should help drive sales growth. Broadridge’s capital markets and wealth management businesses are likely to remain in good shape as long as uncertainty-induced market volatility is prevalent.

The Investor Communication Solutions segment is likely to deliver continued growth as the company sees strong demand trends in its regulatory, data-driven fund, corporate issuer and customer communications solutions. A particularly large portion of the business involves the processing and distribution of proxy materials to investors and the ProxyEdge tool.

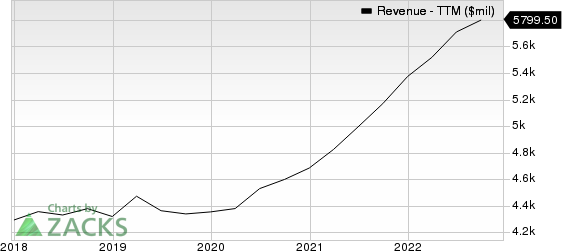

Broadridge Financial Solutions, Inc. Revenue (TTM)

Broadridge Financial Solutions, Inc. revenue-ttm | Broadridge Financial Solutions, Inc. Quote

Increasing presence in EMEA and APAC through the Itiviti acquisition should boost Broadridge’s global technology and operations segment. Itiviti is an effective strategic fit for the company’s capital market franchise and contributes significantly to the company’s international revenue growth.

Some Risks

Broadridge's current ratio at the end of the September quarter was 1.23, lower than 1.25 reported at the end of the prior quarter. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term obligations.

Zacks Rank and Stocks to Consider

Broadridge currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton Holding Corporation BAH and CRA International, Inc. CRAI.

Booz Allen presently carries a Zacks Rank #2 (Buy). BAH has a long-term earnings growth expectation of 8.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8% on average.

CRA International carries a Zacks Rank of 2 at present. CRAI has a long-term earnings growth expectation of 14.3%.

CRA International delivered a trailing four-quarter earnings surprise of 25.7% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report