Here's Why Investors Should Avoid Graco (GGG) Stock Now

We have issued an updated research report on Graco Inc. GGG on Sep 2.

The company currently carries a Zacks Rank #4 (Sell). Its market capitalization is approximately $7.6 billion.

Let’s delve deeper and discuss what led to its poor investment appeal.

Weak Share Price Performance, Over-Valuation and Lowered Estimates: Market sentiments have been against Graco for quite some time now. Its stock price has decreased roughly 4.4% in the past three months compared with the industry’s growth of 2.4%. Also, it is worth noting that shares of the company have lost 11% since the release of second-quarter 2019 results on Jul 24, 2019.

The company’s shares currently seem overvalued compared with the industry, using the P/E (TTM) valuation method. The stock’s current multiple is 23.98x, higher than the industry’s multiple of 20.16x. Also, shares of Graco are trading above the industry's three-month highest level of 20.50x. This makes us cautious about the stock.

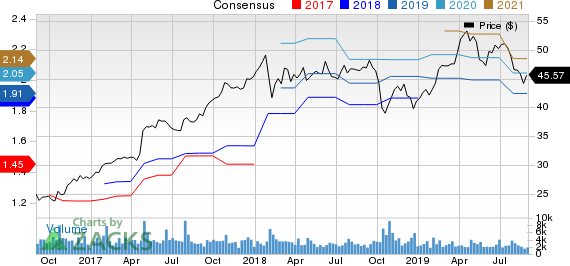

Furthermore, earnings estimates for the company for 2019 and 2020 have been lowered in the past 60 days. Currently, the Zacks Consensus Estimate for its earnings is pegged at $1.91 for 2019 and $2.05 for 2020, reflecting declines of 4.5% and 4.7% from the respective 60-day-ago numbers.

Graco Inc. Price and Consensus

Graco Inc. price-consensus-chart | Graco Inc. Quote

Top-Line Weakness: Graco predicts that challenging macro conditions are concerning. It also anticipates the challenges to adversely impact results in 2019. For the year, the company believes that organic sales (at constant currency rates) will grow in a low-single digit, down from mid-single-digit rise mentioned earlier. Notably, business in the Asia Pacific will likely be weak, with sales to decline in a low-single digit against low-single-digit growth stated earlier.

It is worth mentioning here that Graco’s second-quarter 2019 sales lagged estimates by 4.1%.

Higher Costs: The company’s cost of sales grew roughly 2.7% and 3.4% in the first and second quarters of 2019, respectively. It noted that tariff-related woes and higher materials costs have been playing spoilsport of late.

The company believes that it is likely to face adverse impacts worth $25 million from tariff and higher material costs in 2019. The projection is higher than $21 million mentioned earlier.

Forex Woes: Geographical diversification exposed Graco to headwinds arising from geopolitical issues, macroeconomic challenges and unfavorable movements in foreign currencies. Notably, forex woes lowered sales by 2% in the second quarter of 2019.

For 2019, the company believes that forex woes will adversely impact sales by 1.5%, higher than 1% stated earlier. Also, earning will likely be hurt by 3%.

Stocks to Consider

Some better-ranked stocks in the industry are Graham Corporation GHM, DXP Enterprises, Inc. DXPE and Roper Technologies, Inc. ROP. All these stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for these stocks improved for the current year. Further, earnings surprise for the last reported quarter was 100% for Graham, 4.29% for DXP Enterprises and 0.99% for Roper.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research