Here's Why Investors Should Bet on SkyWest (SKYW) Stock Now

SkyWest SKYW is currently benefiting from upbeat air-travel demand. Against this backdrop, let’s look at the factors that make this stock an attractive pick.

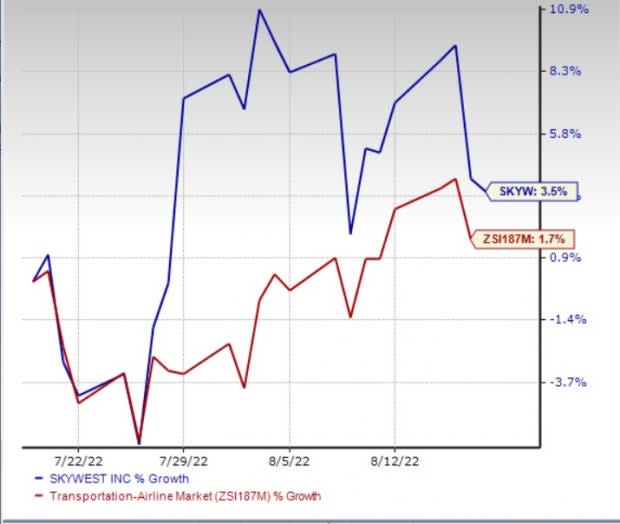

An Outperformer: SkyWest shares have gained 3.5% in a month’s time, surpassing the industry’s uptick of 1.7%.

Image Source: Zacks Investment Research

Solid Rank: SkyWest currently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank of 1 or 2 (Buy) offer attractive investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: The Zacks Consensus Estimate for current-quarter earnings has surged 387% in the past 60 days. Similarly, for current-year earnings, the Zacks Consensus Estimate has skyrocketed in excess of 100% in the past 60 days. The massive upward revisions signal analysts’ confidence in the stock.

Given the wealth of information at brokers' disposal, investors ought to consider their advice and the direction of their estimate revisions. This is because the same serves as an important parameter in determining the stock price.

Stellar Earnings Surprise History: SkyWest has an impressive surprise history. Earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average being a massive 364.09%.

Solid Industry Rank: The industry to which SkyWest belongs, currently has a Zacks Industry Rank of 97 (of 250 plus groups). Such a solid rank places SKYW in the top 38% of the Zacks industries. Studies show that 50% of a stock price movement is directly related to the performance of the industry group it belongs to.

A mediocre stock within a strong group is likely to outclass a robust stock in a weak industry. Therefore, reckoning the industry’s performance becomes imperative.

Other Bullish Factors: Continued recovery in air-travel demand bodes well for SkyWest. With improvement in the same, SkyWest carried 32.7% more passengers in first-half 2022 than the year-ago level. As a result, the passenger load factor (percentage of seats filled by passengers) expanded 1450 basis points to 82.1% in first-half 2022. SKYW’s fleet-modernization efforts are commendable as well.

SKYW has a Momentum Style Score of A. The impressive score highlights the stock’s near-term attractiveness.

Other Stocks Worth a Look

Investors interested in the Zacks Transportation sector may also consider C.H. Robinson CHRW and Ryder System R.

C.H. Robinson is being aided by the improving freight scenario in the United States. Efforts to control costs also bode well. Measures to reward CHRW's shareholders instill more confidence in the stock.

C.H. Robinson has a pleasant earnings track record. The bottom line surpassed the Zacks Consensus Estimate in three of the trailing four quarters (missing the mark in the remaining one). The stock, currently carrying a Zacks Rank #2, has witnessed the Zacks Consensus Estimate for 2022 earnings being revised 17.6% upward over the past 60 days.

Miami, FL-based Ryder provides integrated logistics and transportation solutions. Strong freight market conditions in the United States, upbeat rental demand and favorable pricing are key catalysts for R’s growth.

Shares of Ryder, currently carrying a Zacks Rank of 2, have gained 10.1% in a month’s time. The Zacks Consensus Estimate for R’s 2022 earnings has been revised 4.1% upward in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Ryder System, Inc. (R) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

To read this article on Zacks.com click here.