Here's Why Investors Should Consider Betting on RLI Stock

RLI Corp’s RLI focus on specialty insurance lines, superior underwriting and sturdy financial position along with favorable growth estimates make it a good investment choice.

RLI has a solid track record of beating earnings estimates in the last six quarters.

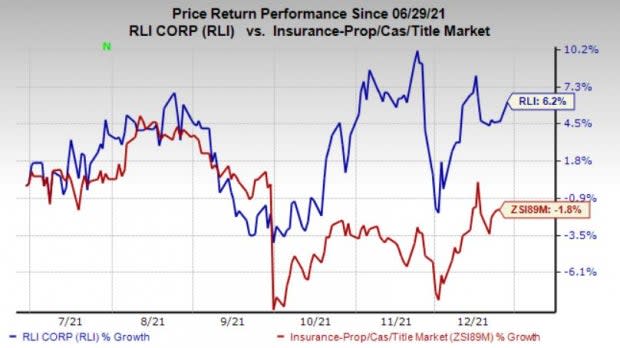

Zacks Rank & Price Performance

RLI currently carries a Zacks Rank #2 (Buy). In the past six months, the stock has gained 6.2% against the industry's decrease of 1.8%.

Image Source: Zacks Investment Research

Growth Projections

The Zacks Consensus Estimate for 2022 earnings is pegged at $3.73, up 6.4% on 10.6% higher revenues of $1.2 billion.

Return on Equity (ROE)

The company’s ROE for the trailing 12 months is 12.8%, comparing favorably with the industry’s 5.6% and reflecting the company’s efficiency in utilizing shareholders’ fund. RLI has averaged 12.2% ROE over the past 10 years.

Business Tailwinds

This specialty insurer has been providing services to diverse niche, property, casualty and surety markets for more than five decades. Strong local branch-office network, diversified and compelling product portfolio, focus on specialty insurance lines, re-underwriting several products and sustained rate increase should continue to help RLI generate higher premiums.

RLI is one of the industry’s most profitable P&C writers with an impressive track record of delivering 25 consecutive years of underwriting profitability, averaging 88.3 and below 90 for 13 straight years, which reflects underwriting excellence. The decision to drop the underperforming products from the property business and maintain significant reinsurance protection against large losses should help RLI maintain its exemplary performance.

A sound capital structure should continue to support RLI in pursuing strategic mergers and acquisitions to grow niches. To stay focused on new markets and product expansion opportunities, RLI has been ramping up its inorganic profile.

Dividend History

RLI has been paying out dividends for 178 consecutive quarters and increased regular dividends in the last 46 straight years. Dividends increased at an eight-year (2014-2021) CAGR of 5.1%. Its dividend yield of 0.9% is better than the industry average of 0.4%, making the stock an attractive pick for yield-seeking investors. This insurer has also been paying out special dividends since 2011.

Other Stocks to Consider

Some other top-ranked stocks from the same space include Hallmark Financial Services HALL, Kinsale Capital Group KNSL and Fidelity National Financial FNF, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hallmark Financial’s 2022 earnings indicates a 30% year-over-year increase. Hallmark Financial delivered a four-quarter average earnings surprise of 53.62%.

The Zacks Consensus Estimate for 2022 earnings of Kinsale indicates a 17% year-over-year increase. Kinsale delivered a four-quarter average earnings surprise of 37.63%.

The Zacks Consensus Estimate for Fidelity National’s 2022 earnings has moved up 4.6% in the past 30 days. Fidelity National delivered a four-quarter average earnings surprise of 38.18%.

Shares of HALL, KNSL and FNF have surged 25%, 15.8% and 32%, respectively, year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF) : Free Stock Analysis Report

Hallmark Financial Services, Inc. (HALL) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research