Here's Why Investors Should Hold Choice Hotels (CHH) Stock

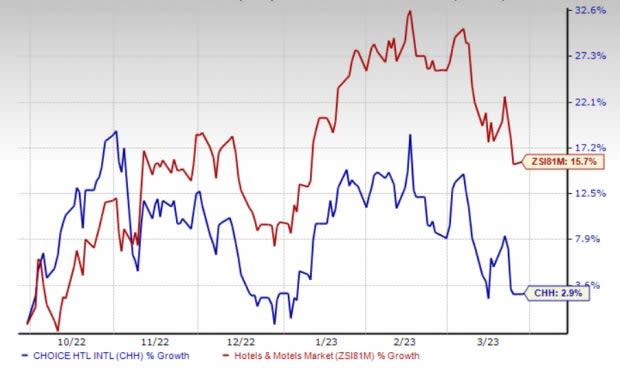

Choice Hotels International, Inc. CHH continues to gain from expansion efforts, the enhancement of mid-scale brand and Radisson Hotels’ acquisition. In the past 6 months, the company’s shares have gained 2.9% compared with the industry’s growth of 15.7%. Although, the company has underperformed the industry in the past 6 months, it has an impressive long-term earnings growth rate of 14.7%.

In 2023, the company’s sales and earnings are likely to witness growth of 7.5% and 12.1%, respectively. In the past 7 days, earnings estimates for 2023 have witnessed upward revisions of 0.3% to $5.91 per share.

Let’s delve deeper.

Growth Drivers

Choice Hotels relies heavily on expansion in domestic and international markets. In 2022, the company awarded 590 domestic franchise agreements (representing an increase of 11% on a year-over-year basis.

Coming to the extended-stay portfolio, the company witnessed rapid expansion, reaching 500 domestic hotels as of Dec 31, 2022. This marked an increase of 34% on a year-over-year basis.

Along with domestic growth, the company continues to expand its international footprint in new countries. Key international operating markets include Spain, Colombia, the Caribbean and Canada. Relatively new to the mid-scale portfolio, Clarion Pointe — part of the popular Clarion brand — is experiencing great success.

Choice Hotels’ Cambria portfolio has been doing solid business. Cambria significantly outperformed the up-scale soft brands (as well as the segment on a whole) in terms of year-over-year RevPAR change. The brand has been well-received on account of smart conversion opportunities.

Image Source: Zacks Investment Research

In 2022, the company’s domestic hotel openings increased 14% year over year, bringing the total count to more than 65 units. Also, it stated that it has additional 65 domestic properties in the pipeline.

Backed by solid consumer confidence and the attractiveness of Choice Hotels value proposition, the company anticipates boosting the revenue intensity of its system by adding more properties. In 2023, the company expects to open 10 additional Cambria hotels.

The Zacks Rank #3 (Hold) company is also benefiting from Radisson Hotels’ acquisition. In fourth-quarter 2022, the addition of the Radisson upscale brands increased Choice's global footprint in the upscale segment to more than 74,000 rooms. In 2022, The Radisson Americas portfolio contributed $104.2 million to total revenues and $18.3 million in adjusted EBITDA.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Las Vegas Sands Corp. LVS, Hilton Grand Vacations Inc. HGV and Crocs, Inc. CROX.

Las Vegas Sands sports a Zacks Rank #1 (Strong Buy) at present. LVS has a long-term earnings growth rate of 2.5%. The stock has gained 37.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LVS’ 2023 sales and EPS indicates a rise of 108.4% and 217.5%, respectively, from the year-ago period’s reported levels.

Hilton Grand Vacations currently flaunts a Zacks Rank #1. HGV has a trailing four-quarter earnings surprise of 12.1%, on average. Shares of HGV have declined 20.4% in the past year.

The Zacks Consensus Estimate for HGV’s 2023 sales and EPS indicates a rise of 7.1% and 10.8%, respectively, from the year-ago period’s levels.

Crocs carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 21.8%, on average. Shares of Crocs have gained 48.3% in the past year.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates increases of 12.5% and 2.5%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report