Here's Why Newpark Resources (NYSE:NR) Has A Meaningful Debt Burden

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Newpark Resources, Inc. (NYSE:NR) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Newpark Resources

How Much Debt Does Newpark Resources Carry?

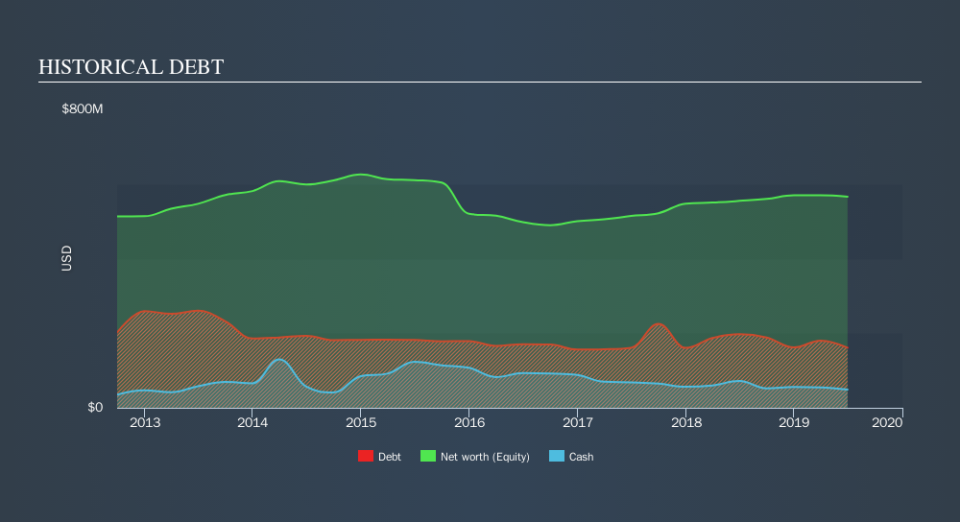

The image below, which you can click on for greater detail, shows that Newpark Resources had debt of US$161.1m at the end of June 2019, a reduction from US$197.2m over a year. However, it does have US$49.0m in cash offsetting this, leading to net debt of about US$112.1m.

A Look At Newpark Resources's Liabilities

Zooming in on the latest balance sheet data, we can see that Newpark Resources had liabilities of US$144.2m due within 12 months and liabilities of US$224.1m due beyond that. On the other hand, it had cash of US$49.0m and US$249.2m worth of receivables due within a year. So its liabilities total US$70.1m more than the combination of its cash and short-term receivables.

Of course, Newpark Resources has a market capitalization of US$675.5m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Newpark Resources's low debt to EBITDA ratio of 1.3 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 2.9 last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Sadly, Newpark Resources's EBIT actually dropped 7.8% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Newpark Resources can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent two years, Newpark Resources recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Both Newpark Resources's interest cover and its EBIT growth rate were discouraging. At least its level of total liabilities gives us reason to be optimistic. Looking at all the angles mentioned above, it does seem to us that Newpark Resources is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Newpark Resources's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.