Here's Why Reed's (NASDAQ:REED) Can Afford Some Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Reed's, Inc. (NASDAQ:REED) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Reed's

How Much Debt Does Reed's Carry?

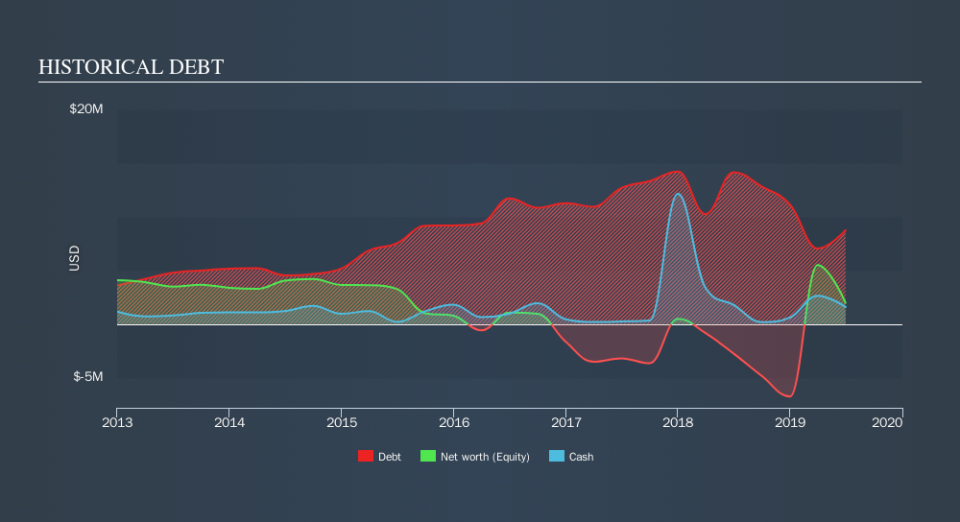

The image below, which you can click on for greater detail, shows that Reed's had debt of US$8.75m at the end of June 2019, a reduction from US$15.9m over a year. On the flip side, it has US$1.60m in cash leading to net debt of about US$7.14m.

How Strong Is Reed's's Balance Sheet?

We can see from the most recent balance sheet that Reed's had liabilities of US$9.03m falling due within a year, and liabilities of US$5.32m due beyond that. Offsetting these obligations, it had cash of US$1.60m as well as receivables valued at US$3.47m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$9.29m.

This deficit isn't so bad because Reed's is worth US$43.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Reed's's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Reed's saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Reed's had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping US$11m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$11m of cash over the last year. So suffice it to say we consider the stock very risky. For riskier companies like Reed's I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.