Here's Why You Should Retain Abiomed (ABMD) Stock For Now

Abiomed, Inc. ABMD is well poised for growth in the coming quarters, backed by strength in its Impella product line. A robust first-quarter fiscal 2022 performance, along with the company’s solid global foothold, is expected to contribute further. Stiff competition and foreign currency woes persist.

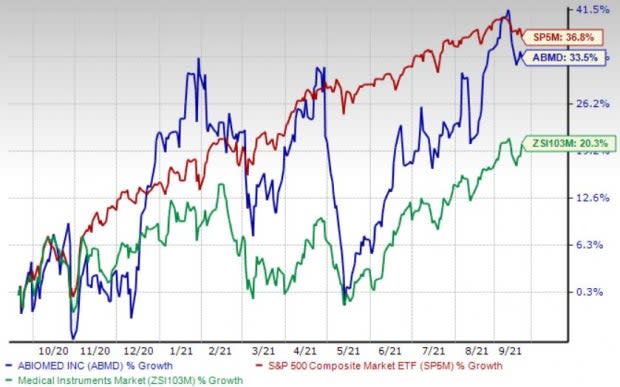

Over the past year, this Zacks Rank #3 (Hold) stock has gained 33.5% compared with 20.4% growth of the industry it belongs to and 36.9% rise of the S&P 500.

The renowned global provider of medical products designed to assist or replace the pumping function of the failing heart, has a market capitalization of $16.11 billion. The company projects 20% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 8.58% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strength in Impella: Abiomed’s flagship product line, Impella, has continued to be a growth driver, which raises our optimism. The company, during its fiscal 2022 first-quarter earnings call in August, confirmed that the Impella 5.5 with SmartAssist has been performing robustly over the past few months. In the quarter, the company’s U.S. Surgical revenues improved significantly as Abiomed expanded the device to 46 more sites. The Impella Connect software has come live at more than 80% of the company’s U.S. sites, and approximately 80% of Abiomed’s U.S. patients on support are monitored through the cloud.

In March 2021, Abiomed unveiled the single-access procedure with Impella CP introducer sheaths for the treatment of heart disease, in Europe.

Solid Global Foothold: The Impella support has already been integrated in hospitals throughout Germany and Japan. The company treated patients in Hong Kong, Australia, Singapore, Israel, and most recently, in India. Abiomed has been making impressive progress with its product line in Japan. The company had received the Japanese Pharmaceuticals and Medical Devices Agency’s (“PMDA”) approval from the Ministry of Health, Labour and Welfare (“MHLW”) in March 2019 for its Impella CP heart pump. Abiomed began selling the Impella CP heart pump in Japan in fiscal year 2020.

The company’s Impella 2.5, Impella CP and Impella 5.0 devices have regulatory approvals from the MHLW of Japan. Abiomed is also targeting submission of the Impella 5.5 device to the PMDA in Japan in fiscal year 2022.

Strong Q1 Results: Abiomed’s solid first-quarter fiscal 2022 results buoy optimism. The company witnessed strength in its global Impella revenues, which is impressive. In June, Abiomed’s Impella RP with SmartAssist received the FDA’s pre-market approval as safe and effective to treat acute right heart failure for up to 14 days. The company also acquired the remaining interest of preCARDIA, which will help its product portfolio to expand options for upstream heart failure patients acutely decompensating. These developments raise our optimism on the stock. Expansion of both margins bodes well for the stock. A raised full-year revenue outlook buoys our optimism.

Downsides

Forex Woes: Abiomed’s reported sales and earnings are subject to fluctuations in foreign currency exchange rates, primarily of the Euro and the Yen, because some of its international sales are denominated in local currencies other than the U.S. dollar. Abiomed is also subject to credit risk and foreign currency risk associated with shipments to its distributors, which could adversely impact the company’s financial condition and liquidity in the future.

Stiff Competition: Abiomed faces competition from other companies offering circulatory care products. It is intense and subject to rapid technological change, and evolving industry requirements and standards. Abiomed competes with companies that have greater financial, product development, sales and marketing resources, and experience. The company’s ability to compete effectively depends upon its ability to distinguish iself and its products from its competitors and their products.

Estimate Trend

Abiomed is witnessing a negative estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 4.8% south to $4.18.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2022 revenues is pegged at $248.4 million, suggesting an 18.4% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, IDEXX Laboratories, Inc. IDXX and Intuitive Surgical, Inc. ISRG.

Henry Schein’s long-term earnings growth rate is estimated to be13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX’s long-term earnings growth rate is estimated to be 19.9%. It currently has a Zacks Rank #2.

Intuitive Surgical’s long-term earnings growth rate is estimated to be 9.7%. It currently flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research