Here's Why You Should Retain Albemarle (ALB) in Your Portfolio

Albemarle Corporation ALB is benefiting from higher lithium volumes and prices, capacity expansion and cost-saving actions amid headwinds from elevated raw material costs.

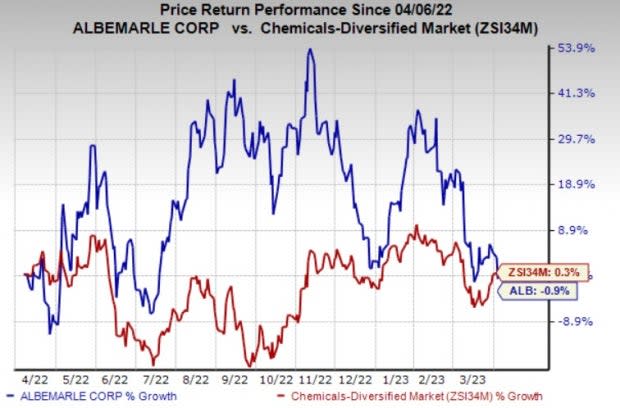

Shares of Albemarle are down 0.9% over a year compared with a 0.3% rise of the industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Aiding ALB?

The North Carolina-based company is gaining from higher volumes in its lithium business. Higher customer demand, new capacity and plant productivity improvements are supporting volumes. The La Negra III/IV expansion in Chile is also contributing to higher volumes. Higher lithium prices are also supporting ALB’s performance.

Albemarle is also benefiting from cost-saving and productivity initiatives. Its cost actions are expected to support its margins in 2023.

The company is also strategically executing its projects aimed at boosting its global lithium conversion capacity. It remains focused on investing in high-return projects to drive productivity. The company is well placed to gain from long-term growth in the battery-grade lithium market.

Albemarle's Kemerton I lithium hydroxide conversion plant in Western Australia achieved first product in July 2022. Kemerton II has also achieved mechanical completion and the plant is progressing through the commissioning phase. The acquisition of the Qinzhou plant in China will also boost the growth of conversion capacity and drive lithium volumes.

Moreover, the company recently announced that it will set up its lithium mega-flex facility in Chester County, SC. The new hydroxide facility will include an initial investment of $1.3 billion or more, enabling the company to meet the increasing demand for electric vehicles and lithium-ion batteries.

Albemarle's Mega-Flex plant will process various lithium feedstock, that includes recycled batteries, to manufacture roughly 50,000 metric tons of battery-grade lithium hydroxide annually. The capacity can be increased to 100,000 metric tons and support the manufacture of about 2.4 million electric vehicles yearly. The facility also aligns with the Inflation Reduction Act, which promotes the localization of crucial minerals in North America.

The company stated that the new facility is designed to boost the production of lithium resources in the United States, which will contribute to the clean energy revolution and enhance proximity with its customers as the North American supply chain expands.

A Few Concerns

The company’s Ketjen unit faces headwinds from higher costs. The business is expected witness challenges, in the near term, from increased input costs as well as higher natural gas costs in Europe due to the Russia-Ukraine war. Albemarle expects raw material cost inflation to remain a headwind for this business in 2023. The company’s Specialties unit is also exposed to higher raw material and freight costs.

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 37.2% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 25% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 60.6% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 40% in a year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 11% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report