Here's Why You Should Retain Allscripts (MDRX) Stock For Now

Allscripts Healthcare Solutions, Inc. MDRX is well poised for growth in the coming quarters, backed by its strategic alliances over the past few months. A robust second-quarter 2021 performance, along with solid prospects in the Sunrise Electronic Health Record (“EHR”) platform, is expected to contribute further. However, integration risks and consolidations in the healthcare industry persist.

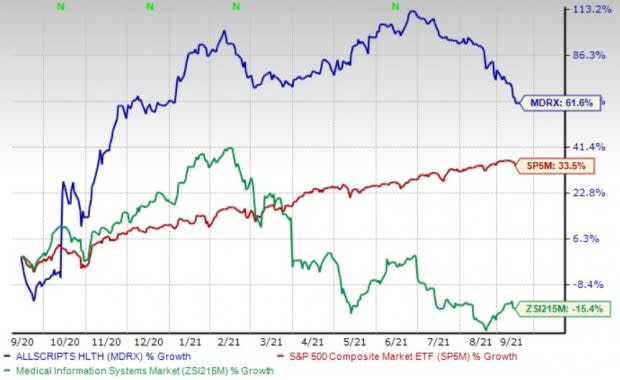

Over the past year, this Zacks Rank #3 (Hold) stock has surged 61.6% against the 15.4% fall of the industry it belongs to and 33.6% rise of the S&P 500 composite.

The renowned IT solutions and services provider has a market capitalization of $1.79 billion. The company projects 9.7% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 24.35% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Alliances: We are optimistic about Allscripts’ partnerships over the past few months. The company, in June, had signed a partnership agreement with PRA Health Sciences (now part of ICON) to create the industry's leading EHR-based clinical research network.

Allscripts, in May, announced that Quincy, IL-based not-for-profit healthcare organization Blessing Health System has substantially expanded its partnership with the company to three facilities, has acquired Allscripts Managed Services, and has also extended its agreement through 2028. The same month, Allscripts’ business unit, Veradigm, collaborated with Lash Group, a part of AmerisourceBergen Corporation ABC.

Sunrise EHR Platform’s Prospects: We believe that the Sunrise EHR platform is an important growth driver for Allscripts. The company, during its second-quarter earnings call in August, confirmed signing an extension of its partnership with BronxCare Health System, into 2031. BronxCare will be adding Sunrise Mobile for nursing, FollowMyHealth, mobile patient engagement, professional services and managed services, and are migrating to Microsoft Azure.

Allscripts, during the same call, also confirmed that it had begun the implementation of its Sunrise platform of health at Mercy Iowa City. Allscripts had announced that Mercy Iowa City has selected its Sunrise platform of health, run on Microsoft Azure, as the core EHR for its community hospital in March 2021.

Also during the second-quarter earnings call, Allscripts confirmed that another of the company’s ambulatory EHR competitors had gone live on Veradigm's eChart Courier network.

Strong Q2 Results: Allscripts’ solid second-quarter 2021 earnings buoy our optimism. The company saw year-over-year uptick in both the top and bottom lines, along with surge in total bookings during the reported quarter, which is also impressive. Revenues from the Client services segment also rose during the quarter. Management is also upbeat about its strong domestic and global pipeline for health systems, which further buoys our optimism on the stock. Expansion of both margins is another positive.

Downsides

Healthcare Industry Consolidations: Many healthcare providers are consolidating their businesses to create integrated healthcare delivery systems with greater market power. As provider networks and managed care organizations consolidate, the number of market participants decreases. This intensifies the competition to provide products and services like Allscripts’ and highlights the importance of establishing and maintaining relationships with key industry participants. These participants may try to use their market power to negotiate price reductions for Allscripts’ products and services.

Integration Risks: Allscripts’ continued reliance on mergers and acquisition activities presents a substantial integration risk for the company. It needs to develop operational synergies from these expansionary activities so that they do not turn out to be a waste of resources. The integration of foreign acquisitions presents additional challenges associated with integrating operations across different cultures and languages, as well as currency and regulatory risks associated with specific countries.

Estimate Trend

Allscripts is witnessing a positive estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 8.1% north to 80 cents.

The Zacks Consensus Estimate for the company’s third-quarter 2021 revenues is pegged at $374.9 million, suggesting a 6.8% fall from the year-ago quarter’s reported number.

Key Picks

A couple of better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC and IDEXX Laboratories, Inc. IDXX.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX’s long-term earnings growth rate is estimated at 19.9%. It currently has a Zacks Rank #2 as well.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research