Here's Why You Should Retain Baxter (BAX) Stock For Now

Baxter International Inc. BAX is well poised for growth in the coming quarters, backed by a strong product portfolio. A robust fourth-quarter 2021 performance, along with positive tidings on the regulatory front, is expected to contribute further. However, generic competition for cyclophosphamide and a sluggish macroeconomic environment are worrying.

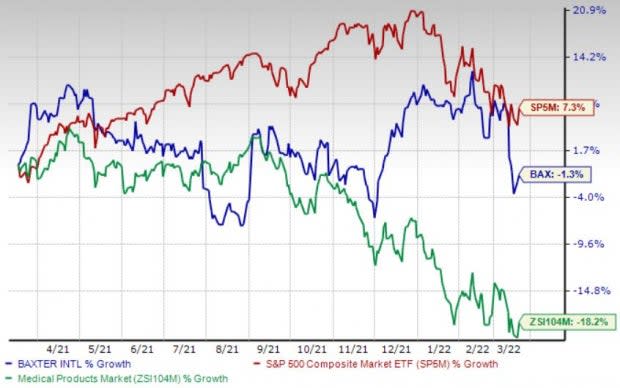

Over the past year, this Zacks Rank #3 (Hold) stock has lost 1.3% compared with 18.2% fall of the industry it belongs to. The S&P 500 composite rose 7.3% in the said time frame.

The renowned global medical technology company has a market capitalization of $39.52 billion. The company projects 10.4% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 9.1% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Regulatory Approvals: We are optimistic about favorable developments on Baxter’s regulatory front. During its fourth-quarter 2021 earnings release, the company announced the FDA approval and commercial launch of premix Norepinephrine Bitartrate in 5% Dextrose Injection (norepinephrine) — a cardiovascular medication indicated to raise blood pressure in adult patients with severe, acute hypotension (low blood pressure). Interestingly, Baxter’s formulation of norepinephrine is the first and only manufacturer-prepared ready-to-use formulation available.

Strong Product Portfolio: We are upbeat about Baxter’s impressive product portfolio with improved existing products and new product development. Management has announced plans of introducing new therapies and products, which are expected to further contribute to sales by 2023. Baxter’s product pipeline comprises the addition of generic injectables and the next generation of its premix technology, among other notable mentions.

Strong Q4 Results: Baxter’s solid fourth-quarter 2021 results buoy optimism. The company witnessed strong performance across six of its business units. Growth in Americas, EMEA and APAC is encouraging. Expansion in both gross and operating margins fuels further optimism. Acquisitions, the commencement of the production of multiple COVID-19 vaccines (on a contract basis) and various launches deserve mention. Baxter’s Hill-Rom buyout positions it well to accelerate both top and bottom-line performances and drive innovation associated with connected care solutions focused on boosting clinical outcomes for patients and enhancing workflow efficiency for customers.

Downsides

Sluggish Macroeconomic Environment: Baxter depends on the European Union for about a third of its sales. This is a cause for concern, given the sluggish macroeconomic environment, a glum outlook for hospital spending and tightening of reimbursement. The outlook also remains slightly uneasy in the United States, where demand for many health care products is soft, with an expectation of further price cuts on account of health care reforms.

Generic Competition for Cyclophosphamide: Cyclophosphamide is a part of Baxter's Hospital Products segment. However, Baxter’s cyclophosphamide performance has lacked luster for the better part of the last five years. Lower cyclophosphamide sales pose threats to the Integrated Pharmacy Solutions franchise business. Despite a promising portfolio, the company has failed to grab significant market share and substantially grow its top line, thanks to generic competition for cyclophosphamide.

Estimate Trend

Baxter is witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 10.5% north to $4.31.

The Zacks Consensus Estimate for the company’s first-quarter 2022 revenues is pegged at $3.67 billion, suggesting a 24.5% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space include Henry Schein, Inc. HSIC, Allscripts Healthcare Solutions, Inc. MDRX and AMN Healthcare Services, Inc. AMN.

Henry Schein, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average beat being 25.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Henry Schein has gained 27.3% compared with the industry’s 4.8% growth over the past year.

Allscripts has an estimated long-term growth rate of 16.3%. MDRX’s earnings surpassed estimates in the trailing four quarters, the average beat being 64.8%. It currently has a Zacks Rank #2.

Allscripts has gained 39.4% against the industry’s 55% fall over the past year.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average beat being 20%. It currently sports a Zacks Rank #1.

AMN Healthcare has gained 33.7% against the industry’s 61.4% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research