Here's Why You Should Retain Emerson (EMR) Stock for Now

Emerson Electric Co. EMR is likely to benefit from strength across its energy, chemicals, metals, commercial, industrial and other end markets in the quarters ahead despite supply-chain woes, and labor, raw material and logistics costs. Also, EMR’s strong backlog level at the Automation Solutions and Commercial & Residential Solutions segments is expected to support its top-line performance in the quarters ahead. For fiscal 2022 (ending September 2022), EMR predicts net sales growth of 7-8% from the year-ago reported figure.

Emerson’s acquisition of Fluxa (July 2022) enables it to leverage Fluxa’s PKM software, its DeltaV control system and life sciences automation software to offer customers a comprehensive line of solutions for developing new drugs. In May 2022, EMR merged its industrial software businesses with Aspen Technology to create “new AspenTech”. The merger enabled it to gain control of a high-valued pure-play industrial software leader, expedite its software strategy and realize substantial synergies. The acquisition of Mita-Teknik (December 2021) expanded its presence in the renewable energy market.

EMR’s measures to reward its shareholders through dividend payments and share buybacks are encouraging. In the first nine months of fiscal 2022, Emerson paid out dividends worth $918 million and repurchased shares of $418 million. The quarterly dividend rate was hiked 2% in November 2021. For fiscal 2022, EMR intends to repurchase $500 million worth of shares.

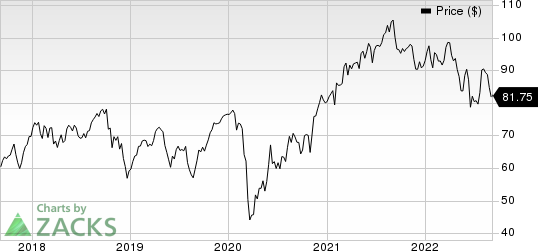

Emerson Electric Co. Price

Emerson Electric Co. price | Emerson Electric Co. Quote

In light of the above-mentioned positives, we believe, investors should retain the Emerson stock for now, as is suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the industrial products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). AIT delivered a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

AIT’s earnings estimates have increased 5.8% for fiscal 2023 (ending June 2023) in the past 60 days. Its shares have rallied 6.2% in the past six months.

Greif, Inc. GEF presently has a Zacks Rank #2 (Buy). GEF delivered a trailing four-quarter earnings surprise of 22.4%, on average.

GEF’s earnings estimates have increased 5.1% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 18.1% in the past six months.

Valmont Industries, Inc. VMI presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has rallied 24.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research