Here's Why You Should Retain National Vision (EYE) Stock Now

National Vision Holdings, Inc. EYE is well-poised for growth in the coming quarters, with the expansion of remote care offerings and strategic investments in optometric recruiting and retention initiatives. In the fourth quarter of 2022, the company successfully rolled out remote medicine and electronic health record capabilities in more than 300 locations and delivered its objective of opening 80 new stores throughout the year. However, tough competition and high dependence on vendors raise apprehension.

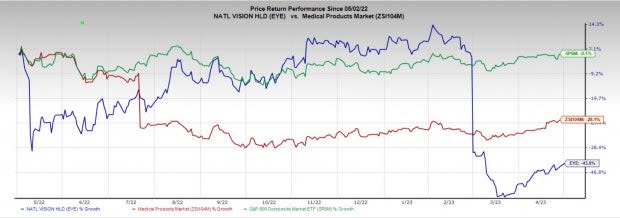

In the past year, this Zacks Rank #3 (Hold) stock has declined 43.8% compared with the 28.1% decline of the industry and a 0.1% fall of the S&P 500 composite.

Headquartered in Georgia, the United States, the leading optical retailer has a market capitalization of $1.64 billion. The company projects earnings growth of 38.5% in 2024, which compares with the industry’s growth expectation of 22.1% and the S&P 500’s estimated 19.2% growth. National Vision surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an earnings surprise of 59.7%, on average.

Let’s delve deeper.

Upsides

Strategies for 2023 Look Promising: National Vision plans to continue executing core growth initiatives and investing in strengthening competitive advantages.

For store expansion, the company continues to see a sizable new opportunity with growth for many years to come. Despite many supply-chain obstacles, National Vision opened 80 stores in 2022 and currently has a solid pipeline of specific locations into 2023. In 2023, the company expects to open approximately 65 to 70 new stores. Further, to support its stores and growing business, EYE intends to start a back-office ERP implementation for its corporate office in the latter half of 2023.

Image Source: Zacks Investment Research

Per National Vision, marketing continues to be a key factor driving traffic to the company’s stores, given the infrequent purchase cycle for eyeglasses. In the current environment of high inflation, the company noted that it continues to focus on marketing efficiency and is content leveraging marketing expenses this year.

In 2022, National Vision funded $114 million in capital expenditures, primarily focused on new stores and customer-facing technology investments. This was in line with the company’s 2022 projected capital expenditures in the range of $110 million - $115 million.

Favorable Industry Trends: Per a report by Grand View Research, the global eyewear market size was valued at $157.9 billion in 2021 and is expected to witness a CAGR of 8.4% between 2022 and 2030. Changing lifestyle patterns and the increasing adoption of luxurious accessories among millennials strongly favor market growth.

Moreover, due to the implementation of remote working models and online learning due to lockdown restrictions, people spent more time on smartphones, laptops, and desktops. Longer screen times urged consumers to spend on anti-fatigue and vision correction glasses, allowing eyewear companies to increase the sales of blue light canceling and anti-fatigue lenses.

The WHO data shows that nearly 2.2 billion individuals worldwide have vision impairment. Of them, 1 billion have a vision impairment that is yet to be addressed. Nearly 2.6 billion suffer from myopia, of which 312 million are under 19, and 1.8 billion suffer from presbyopia.

Per management, an aging population is believed to be a major contributing factor to the U.S. optical retail industry’s growth. A 2019 report by The Vision Council demonstrated that more than 76% of the U.S. adult population uses some form of vision correction.

Uptake From the Fourth Quarter: National Vision had a strong finish to the fourth quarter of 2022, particularly with respect to its managed care sales. The company witnessed a notable improvement in the last week of the year, which is traditionally the time when various annual insurance benefits end.

For EYE’s managed care business, these trends support positive comp growth for both the quarter and the year, representing an increase in customers with vision insurance. Insured customers are less sensitive to elevated inflationary and macro pressures compared to uninsured customers.

In 2023, National Vision finds the possibility to build on this improvement in momentum through investments in many additional initiatives, including increased scheduling options and OD variable compensation program updates. These initiatives were piloted in select markets in the fourth quarter. Given the early positive results, a strategic decision was made to expand these programs throughout the company’s ‘America's Best’ brand in 2023.

Downsides

Tough Competition: National Vision operates in a highly competitive optical retail industry. Companies within the industry generally compete based on the recognition of the brand name, price, convenience, selection, service and product quality.

National Vision competes with national retailers like LensCrafters, Pearle Vision and Visionworks in the broader optical retail industry. Competition exists in physical retail locations along with e-commerce platforms. The company also faces competitive threats from online sellers of contact lenses and eyewear. Many firms are focused on selling eyeglasses in the online market like Warby Parker and Zenni Optical.

High Dependence on Vendors: National Vision procures almost all of its merchandise from domestic and international vendors. Moreover, the company has ties with a very limited number of suppliers for the majority of its eyeglass frames, eyeglass lenses and contact lenses.

Thus, high dependence on a limited number of suppliers exposes it to the concentration of supplier risks. The company has entered into an agreement to purchase nearly all of its spectacle lenses from one vendor.

During 2019, in the pre-pandemic period, 92% of the contact lens expenditure was with three vendors, 51% of the frame expenditure was with two and 88% of the lens expenditure was with one vendor. This exposes the company to vendor concentration risks. Thus, in tough times, EYE may find it difficult to look for an alternative source of procurements timely or cost-effectively.

Estimate Trend

National Vision has been witnessing a negative estimate revision trend for 2023. In the past 60 days, the Zacks Consensus Estimate for its earnings has moved 33.3% south to 60 cents and has been revised 13.3% to 52 cents in the past 7 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $2.12 billion. This suggests a 5.7% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Avanos Medical AVNS and Boston Scientific BSX.

Insulet, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 56.59% for 2024. Insulet’s shares have risen 29% against the industry’s 28.1% decline over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

PODD’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 59.81%.

Avanos Medical, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 19.05% for the next year. AVNS’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 11.01%.

Avanos Medical’s shares have increased 2.4% compared to the industry’s decline of 0.9%.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated growth rate of 13.4% for the next year. Shares of BSX have risen 26.8% against the industry’s 28.1% decline over the past year.

Boston Scientific has an earnings yield of 3.72% compared to the industry’s -3.02%. In the last reported quarter, BSX delivered an earnings surprise of 9.30%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report