Here's Why You Should Retain Packaging Corp (PKG) Stock Now

Packaging Corporation of America PKG is benefiting from solid demand in its packaging segment backed by e-commerce and higher requirements for meat, fruit and vegetables, processed food, beverages, medicine and other consumer products. The company’s focus on acquisitions to expand containerboard and corrugated products portfolio as well as price-hike actions are likely to aid results. However, higher material, energy and wood cost are expected to dent margins.

Packaging Corp currently carries a Zacks Rank #3 (Hold) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3, offer the best investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Upbeat Outlook: Packaging Corp projects earnings per share (EPS) be around $2.04 in fourth-quarter 2021. The company delivered an EPS of $1.30 in fourth-quarter 2020. The guidance reflects strong demand for containerboard and corrugated products in the packaging segment.

Strong Financial Position: During 2016-2020, Packaging Corp’s debt fell at a CAGR of 1%, while its cash flow has witnessed a CAGR of 46% in the same time frame. The company’s liquidity as of Sep 30, 2021, was $1.5 billion. It maintains a balanced approach toward capital allocation to boost growth and maximize shareholders’ returns.

Positive Growth Expectations: The Zacks Consensus Estimate for the company’s current-year EPS is currently pegged at $8.70, indicating year-over-year growth of 50.5%. The same for 2022 stands at $9.38, which suggests a year-over-year improvement of 7.8%.

Positive Earnings Surprise History: Packaging Corp has a trailing four-quarter earnings surprise of 13.1%, on average.

Superior Return on Assets: Packaging Corp currently has a Return on Assets (“ROA”) of 9.7%, higher than the industry’s 6.6%. An above-average ROA indicates that the company is generating earnings by effectively managing assets.

Growth Drivers in Place

Demand in the Packaging segment, which accounts for 89% of the company’s revenues, continues to be strong. Packaging products are essential for the distribution of food, beverage and pharmaceutical products. Hence, the Packaging segment continues to benefit from the elevated demand for meat, fruit and vegetables, processed food, beverages, medicine and other consumer products owing to the coronavirus crisis.

Demand for containerboard and corrugated products remains strong across most of the company’s end markets. Its containerboard mills set an all-time quarterly record sales volume and its box plants set new third-quarter records for the total corrugated product shipments as well as shipments per day. This momentum is expected to continue in the near term. Apart from this, Packaging Corp will continue to benefit from the e-commerce boom that has led to an increase in demand for boxes.

Recently, Packaging Corp entered into an agreement to acquire all of the assets of Advanced Packaging Corporation in a cash-free transaction. Per the agreement, the company will acquire a full-line 500,000-square-foot corrugated products facility located in Grand Rapids, MI. The deal supports Packaging Corp’s focus on enhancing its containerboard portfolio through organic box volume growth and strategic box plant acquisitions. Following the buyout, the company’s containerboard integration is expected to increase by almost 80,000 tons. This will also boost mill capacity and box plant operations. The deal is expected to be immediately accretive to earnings.

However, the company is likely to witness increased energy costs due to higher gas prices and the anticipated colder weather during the fourth quarter. Wood costs in the southern mills will likely be higher due to the wet weather, low inventory and high demand. Management expects inflation to prevail in the near term. Scheduled outage costs are also expected to shoot up in the December-end quarter. These factors are expected to dent fourth-quarter margins.

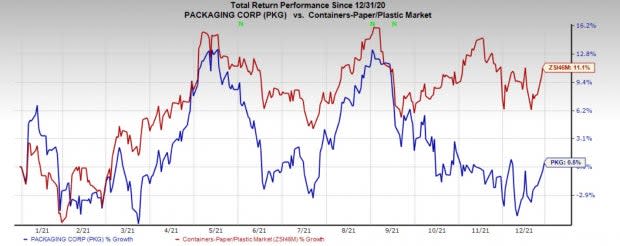

Price Performance

Packaging Corp’s stock has gained 0.5% in the past year compared with the industry’s growth of 11.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Greif, Inc. GEF, SPX Flow FLOW and Emerson Electric Co. EMR. While GEF and FLOW currently flaunt a Zacks Rank #1, EMR carries a Zacks Rank #2.

Greif has an estimated earnings growth rate of 11.4% for the current year. In the past 30 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 2%.

In the past year, the company’s shares have gained 31%. Greif has a trailing four-quarter earnings surprise of 16.8%, on average.

SPX Flow has an expected earnings growth rate of 102% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

SPX Flow’s shares have surged 50.1% in the past year. FLOW has a trailing four-quarter earnings surprise of 40%, on average.

Emerson Electric has a projected earnings growth rate of 19.9% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

EMR’s shares have appreciated 18.3% in a year’s time. Emerson Electric has a trailing four-quarter earnings surprise of 10.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

SPX FLOW, Inc. (FLOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.