Here's Why You Should Retain Stryker (SYK) Stock For Now

Stryker Corporation SYK is well-poised for growth, backed by a robust robotic arm-assisted surgery platform, Mako, and a diversified product portfolio. However, pricing pressure remains a headwind.

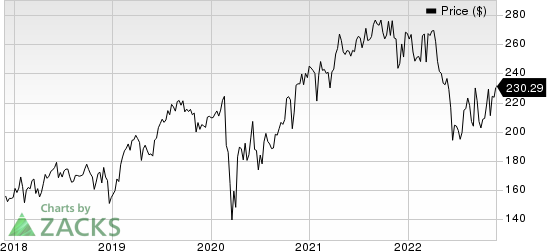

Shares of this Zacks Rank #3 (Hold) company have lost 13.8% compared with the industry’s decline of 45% so far this year. The S&P 500 Index has fallen 16.6% in the same time frame.

Stryker, with a market capitalization of $87.15 billion, is one of the world’s largest medical device companies operating in the orthopedic market. It anticipates earnings to improve 8.8% in the next five years. SYK’s earnings yield of 3.98% compares favorably with the industry’s (3.32%).

Image Source: Zacks Investment Research

What’s Favoring Growth?

Stryker continues to witness strong demand for Mako and a healthy order book, courtesy of the platform’s unique features, despite financial constraints stemming from the COVID-19 pandemic. These, in turn, position it well to sustain momentum in robot sales.

Stryker is committed to the continued expansion of Mako. Although the company saw softening in Mako installation during the third quarter due to variability in the hospital environment, it expects strong demand in the fourth quarter. The company continues to focus on the continued expansion of the platform. This growth reflects the demand for Stryker’s differentiated Mako robotic technology.

Taking into account the normalization of the customer environment, management anticipates another strong year for Mako in 2022. The company’s Mako order book remains solid for 2022 and is in sync with its aim of continued share gains in both hips and knees.

Additionally, Stryker has a diversified product portfolio. Its wide range of products shields the company against any significant sales shortfall during economic turmoil. Its significant exposure to robotics, artificial intelligence for health care and Medical Mechatronics has helped the company stay ahead of the curve in the MedTech space. Stryker’s portfolio includes products like Hip, Knee and Mako robotic-arm assisted surgeries.

On its third-quarter earnings call, Stryker stated that procedural volumes continue to recover in most countries, after getting adversely impacted last year due to COVID. The company stated that it is reaching normalized levels across most of its business. Moreover, it expects hospital staffing pressure to resolve gradually, leading to higher procedures in 2023.

Per management, the company’s sustained support for customers and focus on innovation poise it for growth as the pandemic subsides. In the third quarter of 2022, Stryker’s adjusted R&D expenses were 7.1% of net sales, highlighting its sustained commitment to innovation. Per management, this is likely to drive new product launches. In September, Stryker launched its new Spine Guidance Software — Q Guidance System — for spine application. The company received the FDA’s 510(k) clearance for its OptaBlate bone tumor ablation system in the same month.

Moreover, Stryker’s action to lessen the inflationary pressure and cost-cutting initiatives to improve margins look promising. The 9.2% year-over-year decline in SG&A expenses during the third quarter was probably due to these actions, implying that margins may improve going forward.

What’s Hurting the Stock?

An unfavorable pricing environment poses a persistent threat to Stryker’s core businesses. On the third-quarter 2022 earnings call, the company stated that the period’s average selling days were in line with third-quarter 2021. The impact from pricing was 0.7% in the last reported quarter. Consequently, pricing pressure remains a cause of concern. Moreover, unfavorable currency rate fluctuation has also hurt top-line growth, which may continue to impact revenues moderately in 2023.

Stryker Corporation Price

Stryker Corporation price | Stryker Corporation Quote

Estimate Trend

The Zacks Consensus Estimate for 2022 and 2023 earnings per share is pegged at $9.17 and $9.83, respectively, suggesting year-over-year growth of 0.9% and 7.3%. The consensus mark for 2022 and 2023 revenues stands at $18.22 billion and $19.19 billion, respectively, indicating an improvement of 6.5% and 5.3% year over year.

Stocks to Consider

Some better-ranked stocks in the broader medical space areAMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.96%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcarehas declined 0.3% compared with the industry’s 31.6% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 23.6% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.10%.

ShockWave Medical has gained 48.1% against the industry’s 27.9% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.1%. MCK’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 4.79%.

McKesson has gained 53.2% against the industry’s 14.2% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report