Here's Why I Think Arbor Realty Trust (NYSE:ABR) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Arbor Realty Trust (NYSE:ABR). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Arbor Realty Trust

Arbor Realty Trust's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Arbor Realty Trust has grown EPS by 25% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

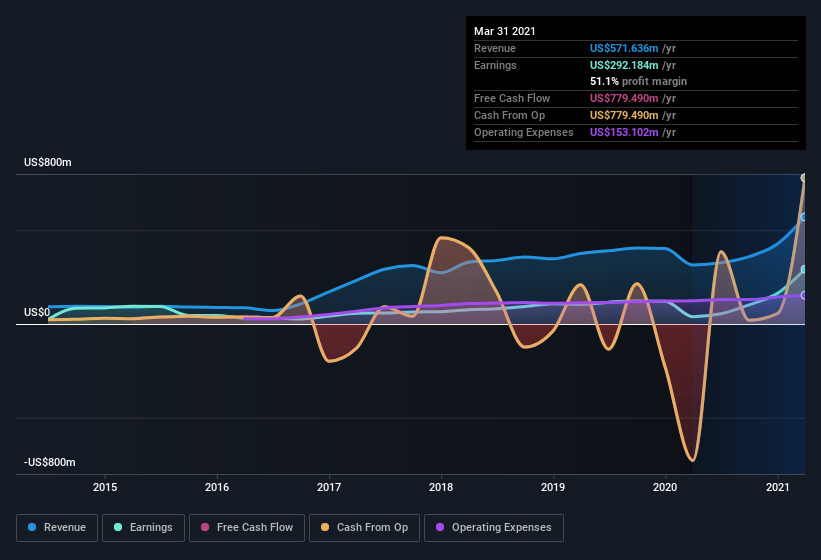

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Arbor Realty Trust's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Arbor Realty Trust maintained stable EBIT margins over the last year, all while growing revenue 81% to US$572m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Arbor Realty Trust?

Are Arbor Realty Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

For the sake of balance, I do note Arbor Realty Trust insiders sold -US$118k worth of shares last year. But that is far less than the large US$177k share acquisition by Lead Independent Director William Green.

On top of the insider buying, it's good to see that Arbor Realty Trust insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$66m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

Should You Add Arbor Realty Trust To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Arbor Realty Trust's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 3 warning signs for Arbor Realty Trust (of which 1 doesn't sit too well with us!) you should know about.

The good news is that Arbor Realty Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.