Here's Why I Think Auswide Bank (ASX:ABA) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Auswide Bank (ASX:ABA). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Auswide Bank

Auswide Bank's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Auswide Bank managed to grow EPS by 5.0% per year, over three years. While that sort of growth rate isn't amazing, it does show the business is growing.

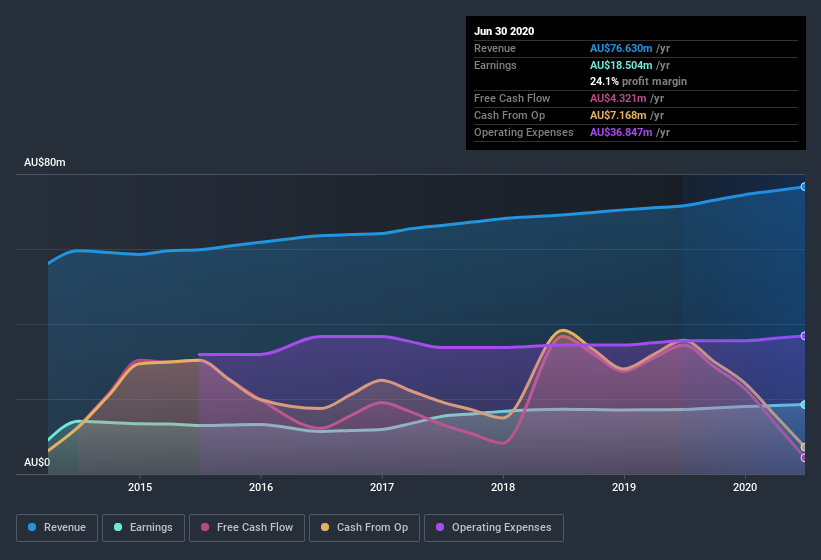

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Auswide Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Auswide Bank's EBIT margins were flat over the last year, revenue grew by a solid 7.1% to AU$77m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Auswide Bank's forecast profits?

Are Auswide Bank Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Auswide Bank insiders have a significant amount of capital invested in the stock. To be specific, they have AU$34m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 13% of the company; visible skin in the game.

Is Auswide Bank Worth Keeping An Eye On?

As I already mentioned, Auswide Bank is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Before you take the next step you should know about the 1 warning sign for Auswide Bank that we have uncovered.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.