Here's Why We Think Insmed Incorporated's (NASDAQ:INSM) CEO Compensation Looks Fair for the time being

Performance at Insmed Incorporated (NASDAQ:INSM) has been reasonably good and CEO Will Lewis has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 12 May 2021. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Insmed

How Does Total Compensation For Will Lewis Compare With Other Companies In The Industry?

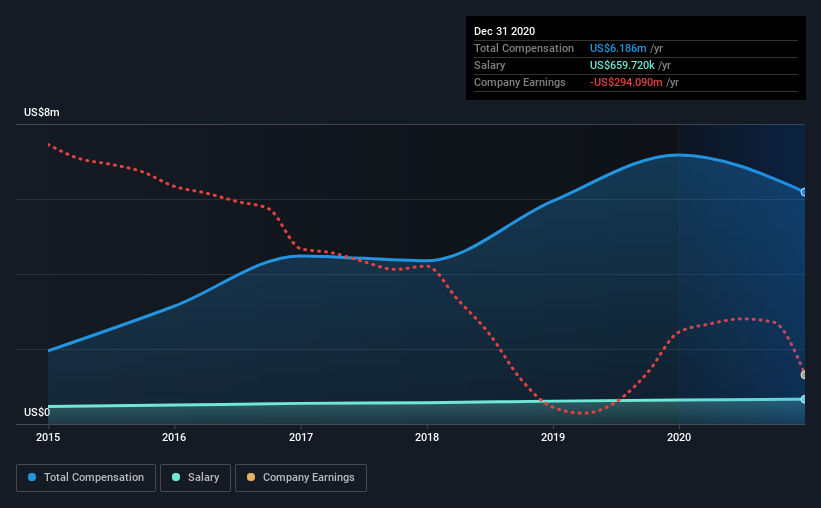

At the time of writing, our data shows that Insmed Incorporated has a market capitalization of US$3.2b, and reported total annual CEO compensation of US$6.2m for the year to December 2020. That's a notable decrease of 14% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$660k.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$6.3m. So it looks like Insmed compensates Will Lewis in line with the median for the industry. What's more, Will Lewis holds US$5.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$660k | US$641k | 11% |

Other | US$5.5m | US$6.5m | 89% |

Total Compensation | US$6.2m | US$7.2m | 100% |

Talking in terms of the industry, salary represented approximately 22% of total compensation out of all the companies we analyzed, while other remuneration made up 78% of the pie. Insmed sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Insmed Incorporated's Growth

Insmed Incorporated has seen its earnings per share (EPS) increase by 7.7% a year over the past three years. Its revenue is up 20% over the last year.

We would argue that the modest growth in revenue is a notable positive. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Insmed Incorporated Been A Good Investment?

Insmed Incorporated has generated a total shareholder return of 14% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Insmed that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.