Here's Why We Think Middlefield Banc (NASDAQ:MBCN) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Middlefield Banc (NASDAQ:MBCN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Middlefield Banc with the means to add long-term value to shareholders.

See our latest analysis for Middlefield Banc

How Quickly Is Middlefield Banc Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Middlefield Banc grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

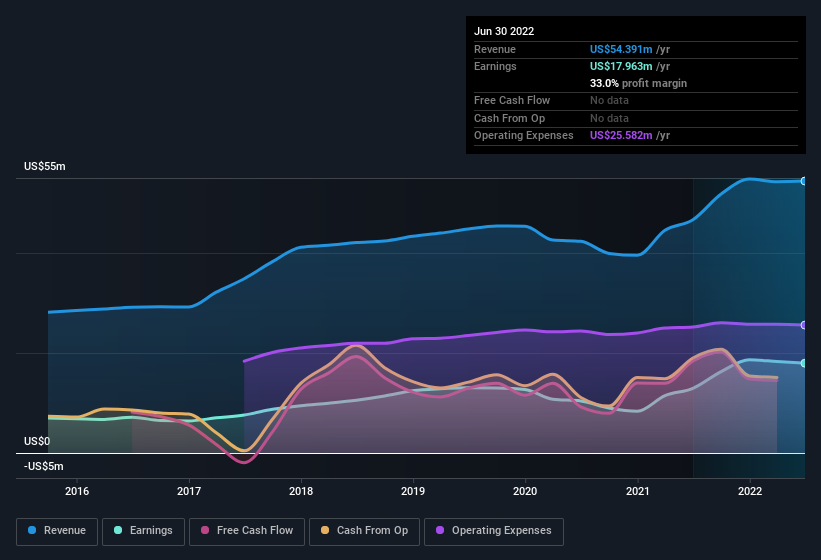

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Middlefield Banc's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Middlefield Banc maintained stable EBIT margins over the last year, all while growing revenue 17% to US$54m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Middlefield Banc.

Are Middlefield Banc Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Middlefield Banc insiders walking the walk, by spending US$301k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Independent Director Kenneth Jones who made the biggest single purchase, worth US$100k, paying US$24.90 per share.

It's commendable to see that insiders have been buying shares in Middlefield Banc, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations under US$200m, like Middlefield Banc, the median CEO pay is around US$772k.

Middlefield Banc offered total compensation worth US$398k to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Middlefield Banc Worth Keeping An Eye On?

One positive for Middlefield Banc is that it is growing EPS. That's nice to see. And there's more to love too, with modest CEO remuneration and insider buying interest continuing the positives for the company. The sum of all that, points to a quality business, and a genuine prospect for further research. Now, you could try to make up your mind on Middlefield Banc by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Middlefield Banc, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here