Here's Why We Think Peoples Financial Services (NASDAQ:PFIS) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Peoples Financial Services (NASDAQ:PFIS), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Peoples Financial Services

Peoples Financial Services's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Peoples Financial Services managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

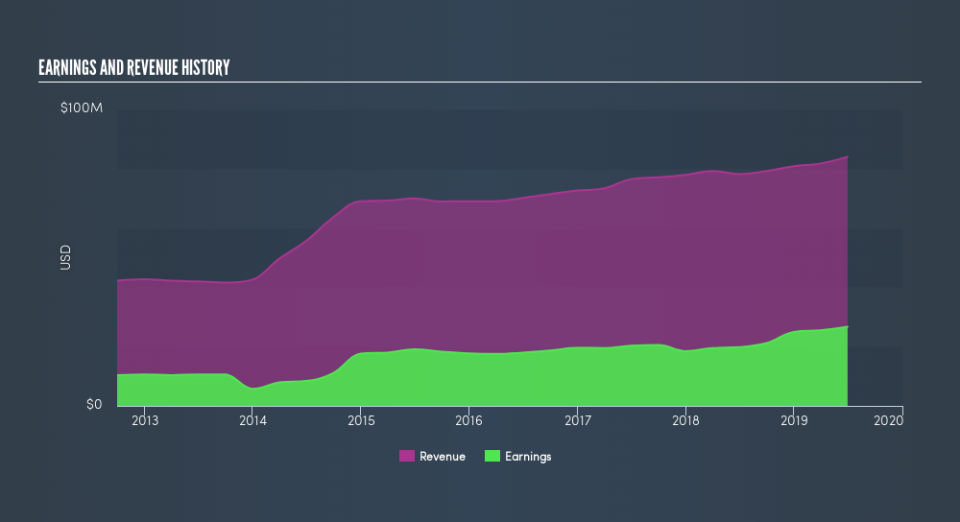

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Peoples Financial Services's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Peoples Financial Services maintained stable EBIT margins over the last year, all while growing revenue 7.5% to US$84m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Peoples Financial Services's balance sheet strength, before getting too excited.

Are Peoples Financial Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -US$4.2k worth of shares. But that's far less than the US$835k insiders spend purchasing stock. This makes me even more interested in Peoples Financial Services because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Senior EVP & COO Thomas Tulaney for US$328k worth of shares, at about US$41.00 per share.

On top of the insider buying, it's good to see that Peoples Financial Services insiders have a valuable investment in the business. Indeed, they hold US$29m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 8.1% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Craig Best is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Peoples Financial Services, the median CEO pay is around US$1.8m.

The Peoples Financial Services CEO received US$918k in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Peoples Financial Services To Your Watchlist?

As I already mentioned, Peoples Financial Services is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Now, you could try to make up your mind on Peoples Financial Services by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Peoples Financial Services is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.