Here's Why We Think RIWI (FRA:5RW) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like RIWI (FRA:5RW). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for RIWI

How Fast Is RIWI Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that RIWI's EPS went from US$0.0076 to US$0.051 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

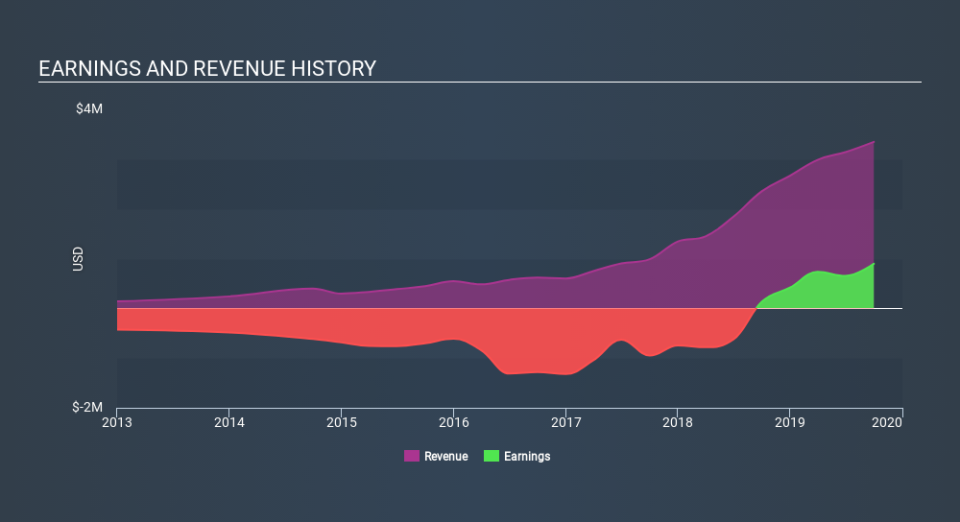

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that RIWI is growing revenues, and EBIT margins improved by 21.1 percentage points to 26%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

RIWI isn't a huge company, given its market capitalization of €24m. That makes it extra important to check on its balance sheet strength.

Are RIWI Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling RIWI shares, in the last year. So it's definitely nice that Founder Neil Seeman bought US$6.8k worth of shares at an average price of around US$1.69.

It's me that RIWI insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. I refer to the very reasonable level of CEO pay. For companies with market capitalizations under US$200m, like RIWI, the median CEO pay is around US$215k.

The RIWI CEO received US$143k in compensation for the year ending December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add RIWI To Your Watchlist?

RIWI's earnings per share have taken off like a rocket aimed right at the moon. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests RIWI may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if RIWI is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of RIWI, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.