Here's Why I Think TC Energy (TSE:TRP) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like TC Energy (TSE:TRP). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for TC Energy

How Fast Is TC Energy Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. TC Energy managed to grow EPS by 11% per year, over three years. That's a good rate of growth, if it can be sustained.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. TC Energy reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

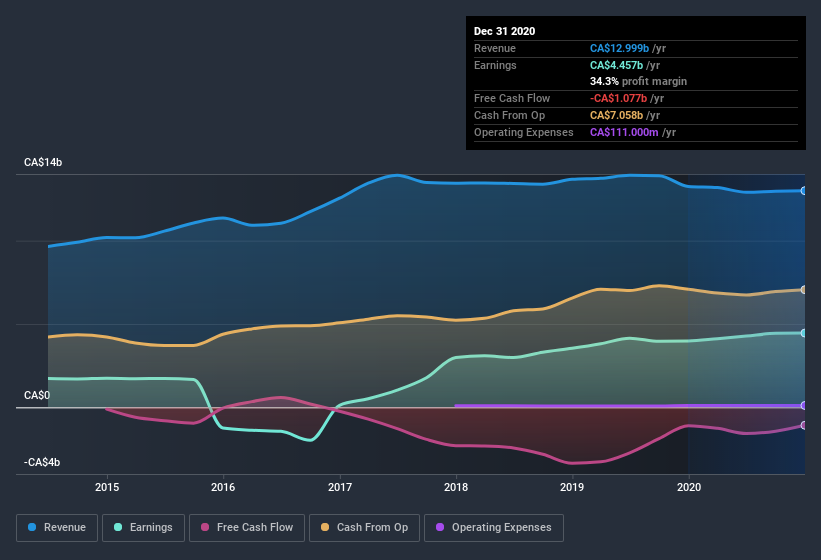

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for TC Energy's future profits.

Are TC Energy Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth -CA$1.2m) this was overshadowed by a mountain of buying, totalling CA$7.4m in just one year. I find this encouraging because it suggests they are optimistic about the TC Energy's future. We also note that it was the CEO, President & Director, Francois Poirier, who made the biggest single acquisition, paying CA$1.1m for shares at about CA$56.97 each.

Along with the insider buying, another encouraging sign for TC Energy is that insiders, as a group, have a considerable shareholding. Indeed, they hold CA$40m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.07% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Francois Poirier, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like TC Energy, with market caps over CA$10.0b, is about CA$8.2m.

TC Energy offered total compensation worth CA$6.3m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does TC Energy Deserve A Spot On Your Watchlist?

One important encouraging feature of TC Energy is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 2 warning signs for TC Energy (1 makes us a bit uncomfortable!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of TC Energy, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.