Here's Why I Think VSTECS Holdings (HKG:856) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like VSTECS Holdings (HKG:856). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for VSTECS Holdings

How Quickly Is VSTECS Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. VSTECS Holdings managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

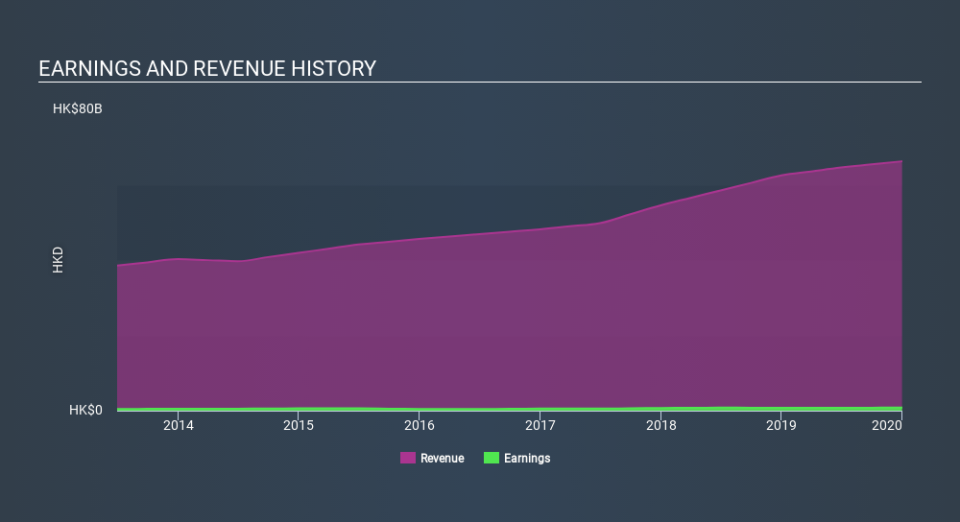

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). VSTECS Holdings maintained stable EBIT margins over the last year, all while growing revenue 6.0% to HK$66b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for VSTECS Holdings's future profits.

Are VSTECS Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for VSTECS Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Chairman & CEO Jialin Li paid HK$11m, for stock at HK$3.94 per share. It doesn't get much better than that, in terms of large investments from insiders.

And the insider buying isn't the only sign of alignment between shareholders and the board, since VSTECS Holdings insiders own more than a third of the company. Actually, with 41% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a whopping HK$2.2b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add VSTECS Holdings To Your Watchlist?

One important encouraging feature of VSTECS Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for VSTECS Holdings (1 can't be ignored) you should be aware of.

As a growth investor I do like to see insider buying. But VSTECS Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.