Here's Why We're Wary Of Buying Nielsen Holdings' (NYSE:NLSN) For Its Upcoming Dividend

Nielsen Holdings plc (NYSE:NLSN) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Nielsen Holdings' shares before the 2nd of June in order to be eligible for the dividend, which will be paid on the 17th of June.

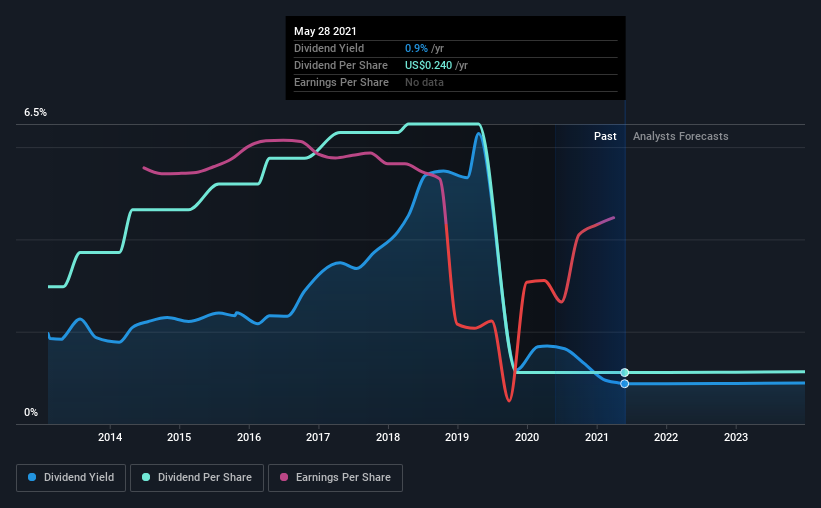

The company's next dividend payment will be US$0.06 per share. Last year, in total, the company distributed US$0.24 to shareholders. Looking at the last 12 months of distributions, Nielsen Holdings has a trailing yield of approximately 0.9% on its current stock price of $27.48. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Nielsen Holdings can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Nielsen Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Nielsen Holdings distributed an unsustainably high 191% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether Nielsen Holdings generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 19% of its cash flow last year.

It's good to see that while Nielsen Holdings's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Nielsen Holdings's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 39% a year over the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Nielsen Holdings's dividend payments per share have declined at 12% per year on average over the past eight years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

The Bottom Line

Is Nielsen Holdings worth buying for its dividend? It's never great to see earnings per share declining, especially when a company is paying out 191% of its profit as dividends, which we feel is uncomfortably high. Yet cashflow was much stronger, which makes us wonder if there are some large timing issues in Nielsen Holdings's cash flows, or perhaps the company has written down some assets aggressively, reducing its income. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Nielsen Holdings.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Nielsen Holdings. We've identified 2 warning signs with Nielsen Holdings (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.