Hershey (HSY) Jumps More Than 25% in a Year: Here's Why

The Hershey Company HSY is well-positioned, courtesy of its effective pricing actions. The leading snacks company’s solid brand portfolio and innovations are noteworthy. The company’s strategic acquisitions are boosting portfolio strength.

The aforementioned aspects were evident in its third-quarter 2022 results, with the top and the bottom line surpassing the Zacks Consensus Estimate and increasing year over year. Impressively, management raised its 2022 net sales and earnings view.

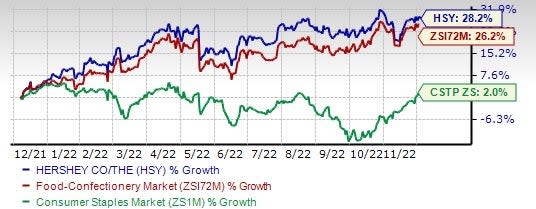

This Zacks Rank #2 (Buy) stock has rallied 28.2% in a year compared with the industry’s 26.2% growth. The stock has outperformed the Zacks Consumer Staples sector, rising 2% in the period.

Let’s delve deeper.

Solid Q3 Results & Raised View

Hershey posted adjusted earnings of $2.17, increasing 3.3% in the third quarter of 2022. Consolidated net sales of $2,728.2 million rose 15.6%, with all segments recording double-digit organic growth fueled by price and volume gains. Organic sales on a constant-currency (cc) basis increased 11.8%. Results benefited from higher brand investments and an enhanced supply chain, which supported the company’s consumer demand and fueled category growth in all business segments.

The company raised its 2022 view to reflect greater-than-expected consumer demand and positive price elasticities across segments. Management now envisions net sales growth in the band of 14-15% for 2022. Earlier, net sales were expected to grow 12-14%. Hershey expects adjusted earnings per share (EPS) in the range of $8.20-$8.27, up 14-15% for 2022. Reported EPS growth is likely to be in the 11-13% band. Earlier, management had projected adjusted EPS to increase 12-14%, while reported EPS growth was likely in the 9-12% band.

Image Source: Zacks Investment Research

Pricing & Brand Strength Bodes Well

Hershey is undertaking strategic pricing initiatives to improve its performance. In third-quarter 2022, net price realization contributed 7.7 points to net sales growth. In the North America Confectionery segment, net price realization contributed 7.7 points to net sales. In the North America Salty Snacks segment, net price realization contributed 12.5 points to net sales growth. Price realization contributed 4.4 points to sales in the International unit. Focus on strategic pricing actions is helping Hershey mitigate the impacts of rising inflation.

Hershey regularly brings innovation to its core brands to meet consumer demand and needs that are not addressed by its current portfolio. The company anticipates momentum to continue into the Holiday season, with its products already out in stores and selling well. In addition, it is committed to supporting brands through solid media marketing. An important strategy of the company is to create a unique and holistic portfolio for every season, which can meet consumers’ seasonal shopping needs.

Buyouts Driving Growth

Hershey has been undertaking buyouts to augment portfolio strength and boost revenues. In December 2021, Hershey acquired Dot’s Pretzels LLC — the owner of Dot’s Homestyle Pretzels, a leading brand in the pretzel category. The addition of Dot’s Pretzels is a perfect match for Hershey’s growing salty snacking portfolio. The company also purchased Pretzels Inc. from an affiliate of Peak Rock Capital. The acquisition further expands Hershey’s snacking and production capabilities. On Jun 25, 2021, Hershey concluded the acquisition of Lily's, a leading better-for-you (BFY) confectionery brand. The buyout is in tandem with Hershey’s focus on creating an impressive BFY confection portfolio as part of its multi-pronged, better-for-you snacking strategy.

In the third quarter of 2022, net sales included a 4.1-point benefit from the Pretzels and Dot's buyouts. The impact of Pretzels, Dot's and Lily's buyouts is likely to add a 4-5 point benefit to net sales.

We believe that well-chalked growth endeavors like strategic buyouts, innovation and pricing efforts will likely keep HSY’s growth story going.

3 Solid Staple Picks

Some top-ranked stocks are The Chef's Warehouse CHEF, General Mills GIS and Conagra Brands CAG.

The Chef's Warehouse, which distributes specialty food products, currently sports a Zacks Rank #1 (Strong Buy). Chef's Warehouse has a trailing four-quarter earnings surprise of 93.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial year sales suggests growth of 46.5% from the year-ago reported number, while earnings indicate significant growth.

General Mills, which manufactures and markets branded consumer foods, carries a Zacks Rank #2 at present. General Mills has a trailing four-quarter earnings surprise of 6.1%, on average.

The Zacks Consensus Estimate for GIS’ current financial year sales and earnings suggests growth of 2.7% and 3.8%, respectively, from the year-ago reported numbers.

Conagra Brands, operating as a consumer-packaged goods food company, currently carries a Zacks Rank of 2. CAG has a trailing four-quarter earnings surprise of 1.8%, on average.

The Zacks Consensus Estimate for Conagra Brands’ current financial year sales and earnings suggests growth of 5.2% and 3.4%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report