Hewlett Packard (HPE) Q1 Earnings and Revenues Beat Estimates

Hewlett Packard Enterprise HPE started fiscal 2023 on a strong note by reporting better-than-expected financial results for the first quarter. Also, the reported financial results reflected the company’s highest first-quarter revenues since 2016 and the best-ever non-GAAP operating margin.

Hewlett Packard reported first-quarter fiscal 2023 non-GAAP earnings of 63 cents per share, which came way ahead of the Zacks Consensus Estimate of 52 cents. The reported figure was 19% higher than the year-ago quarter’s earnings of 53 cents per share.

Revenues of $7.8 billion increased 12% from the prior-year quarter and surpassed the consensus mark of $7.4 billion. The annualized revenue run rate was up 26% year over year to $1 billion.

Hewlett Packard continued to witness the increased demand for its products and services during the quarter. Moreover, an improvement in the supply chain helped the company deliver customer orders, which boosted the overall quarterly performance. Despite high inflationary pressure, macroeconomic headwinds and geopolitical issues, the company witnessed an increase in earnings and sales.

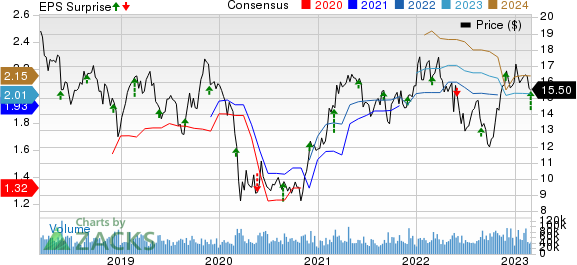

Hewlett Packard Enterprise Company Price, Consensus and EPS Surprise

Hewlett Packard Enterprise Company price-consensus-eps-surprise-chart | Hewlett Packard Enterprise Company Quote

Segment Performance

Segment-wise, High-Performance Compute & Artificial Intelligence’s revenues increased 34% year over year to $1.06 billion. The segment’s operating margin improved 100 basis points (bps) year over year to 0.1%.

The Compute division’s sales soared 14% year over year to $3.46 billion. The division witnessed 360 bps operating profit margin expansion to 17.6%.

Revenues in the Intelligent Edge division rose 25% year over year to $1.13 billion during the quarter, primarily driven by strong customer demand. The operating margin of the segment improved 450 bps to 21.9%

Financial Service’s revenues increased 4% to $873 million. The segment’s operating margin decreased 300 bps to 9.4%. Net portfolio assets increased 2% to roughly $13.2 billion.

Revenues from the Storage business were up 5% year over year to $1.19 billion. Meanwhile, the operating margin dipped 190 bps to 12%.

Corporate Investments & Other revenues stood at $293 million, down 10% year over year.

Operating Results

The non-GAAP gross profit increased 13.3% to $2.67 billion. Meanwhile, the non-GAAP margin improved 30 bps to 34.2%.

Hewlett Packard’s non-GAAP operating profit increased 19.5% to $918 million, while the non-GAAP operating margin improved 80 bps year over year to 11.8%. The company continued to save from the cost optimization plan and invest in high-growth, margin-rich portfolios in the first quarter of fiscal 2023.

Balance Sheet and Cash Flow

Hewlett Packard ended the fiscal first quarter with $2.53 billion in cash and cash equivalents compared with $4.16 billion at the end of the previous quarter.

In the fiscal first quarter, Hewlett Packard used $829 million in cash for operational activities and generated free cash flow of -$1.3 billion.

Hewlett Packard returned $229 million to shareholders through repurchasing $156 million worth of its common stock and $73 million in dividend payments in the reported quarter.

Guidance

Hewlett Packard initiated guidance for the second quarter and raised the outlook for fiscal 2023. The company forecasts to generate revenues between $7.1 billion and $7.5 billion in the second quarter. For the fiscal second quarter, the company estimates GAAP and non-GAAP earnings per share in the range of 27-35 cents and 44-52 cents, respectively.

For fiscal 2023, the company raised its GAAP and non-GAAP earnings per share guidance ranges to $1.40-$1.48 and $2.02-$2.10, respectively, from the previous guidance ranges of $1.38-$1.46 and $1.96-$2.04. Moreover, the company now estimates revenues to grow in the range of 5%-7% adjusted for currency. HPE continues to anticipate free cash flow in the band of $1.9-$2.1 billion.

Zacks Rank & Stocks to Consider

Hewlett Packard currently carries a Zacks Rank #3 (Hold). Shares of HPE have declined 8.8% over the past year.

Some better-ranked stocks from the broader technology sector are Clarivate Plc CLVT, Aspen Technology AZPN and ServiceNow NOW, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Clarivate’s first-quarter 2023 earnings has been revised a penny northward to 17 cents per share over the past 60 days. For 2023, earnings estimates have been revised a penny northward to 80 cents per share in the past 60 days.

Clarivate's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 15.6%. Shares of CLVT have fallen 20.7% in the trailing 12 months.

The Zacks Consensus Estimate for Aspen Technology's third-quarter fiscal 2023 earnings has been revised upward by 17 cents to $1.66 per share in the past 60 days. For fiscal 2023, earnings estimates have been revised northward by 2 cents to $7.10 per share in the past 30 days.

Aspen Technology’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 5.2%. Shares of AZPN have rallied 48.8% over the past year.

The Zacks Consensus Estimate for ServiceNow's first-quarter 2023 earnings has been revised northward by a penny to $2.02 per share over the past 30 days. For 2023, earnings estimates have moved downward by 3 cents to $9.15 per share in the past seven days.

ServiceNow's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6.9%. Shares of NOW have plunged 25.7% in the trailing 12 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Clarivate PLC (CLVT) : Free Stock Analysis Report