Hexcel (HXL) Q3 Earnings Beat Estimates, Revenues Up Y/Y

Hexcel Corporation HXL reported third-quarter 2019 earnings of 90 cents per share, which surpassed the Zacks Consensus Estimate of 89 cents by 1.1%. The bottom line also improved 12.5% from the prior-year quarter’s 80 cents. The year-over-year upside can be attributed to robust sales and margin improvement.

The company reported GAAP earnings of 93 cents per share compared with the year-ago quarter’s 91 cents.

Total Sales

Net sales totaled $572.5 million, which missed the Zacks Consensus Estimate of $604 million by 5.2%. However, net sales improved 5.9% from the year-ago quarter’s $540.5 million on growth in the company’s Commercial Aerospace, and Space and Defense segments.

Operational Update

Hexcel’s gross margin was 27.6% in the third quarter, expanding 110 basis points year over year. The improvement reflects strong operational execution.

The company’s operating expenses amounted to $48 million in the third quarter compared with the year-ago quarter’s $46.5 million. Selling, general and administrative expenses grew 3.7%, while research and technology expenses rose 2.2%.

Segmental Performance

Commercial Aerospace: Net sales increased 3.4% year over year to $385.9 million. The uptick can be attributed to the strong performance of the Airbus A320neo, Airbus A350 and Boeing 787 programs.

Space and Defense: Net sales grew 21.5% year over year to $109.8 million, primarily owing to the growth in the F-35 Joint Strike Fighter program.

Industrial: Net sales declined 0.3% year over year to $76.8 million on low automotive sales.

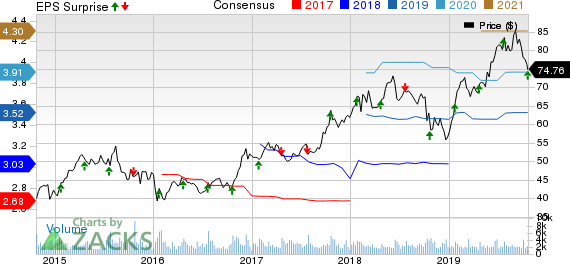

Hexcel Corporation Price, Consensus and EPS Surprise

Hexcel Corporation price-consensus-eps-surprise-chart | Hexcel Corporation Quote

Financial Details

As of Sep 30, 2019, cash and cash equivalents were $47 million compared with $32.7 million as of Dec 31, 2018.

Long-term debt totaled $1,115.2 million as of Sep 30, 2019, up from $947.4 million as of Dec 31, 2018.

At the end of third-quarter 2019, cash generated from operating activities summed $277.3 million compared with $278.4 million generated at the end of third-quarter 2018.

The effective tax rate was 18.4% in the reported quarter compared with 9.1% in the third quarter of 2018. Free cash flow was $114.6 million for the first nine months of 2019 compared with $128.2 million for the same period last year.

2019 Guidance

For 2019, Hexcel lowered its sales guidance to $2.34-$2.40 billion from $2.38-$2.48 billion. The Zacks Consensus Estimate for full-year sales, pegged at $2.43 billion, lies above the company’s projected view.

Hexcel projects the adjusted earnings per share to be $3.43-$3.53 for the year. The Zacks Consensus Estimate for the company’s 2019 earnings, pegged at $3.52, toward the endpoint of the company’s guided range.

Hexcel expects free cash flow to exceed $250 million and accrual basis capital expenditures between $170 million and $190 million for 2019.

Zacks Rank

Hexcel currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Defense Releases

Leidos Holdings Inc. LDOS, a Zacks Rank #3 stock, is set to report third-quarter 2019 results on Oct 29.

General Dynamics Corp. GD, a Zacks Rank #3 stock, is scheduled to report third-quarter 2019 results on Oct 23.

Raytheon Company RTN, a Zacks Rank #4 (Sell) stock, is scheduled to report third-quarter 2019 results on Oct 24.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Raytheon Company (RTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research