Will High Costs Dent Newmont (NEM) This Earnings Season?

Newmont Mining Corporation NEM is scheduled to report third-quarter 2018 results on Oct 25, before the opening bell.

In the last reported quarter, the gold miner delivered a positive earnings surprise of 8.3% by posting adjusted earnings of 26 cents per share that beat the Zacks Consensus Estimate of 24 cents. The bottom line was driven by higher realized gold prices, lower income taxes and gain realized from sales royalty portfolio, partly offset by lower production at Boddington, Cripple Creek & Victor (“CC&V”), Akyem and Twin Creeks.

Revenues, however, fell around 11% year over year to $1,662 million. It missed the Zacks Consensus Estimate of $1754.7 million.

Notably, Newmont surpassed expectations in three of the trailing four quarters with an average positive surprise of 6.8%.

The stock has lost 12.6% in the past three months compared with the industry’s decline of 7.1%.

Will the company surprise investors this quarter or is it heading for a possible pullback? Let’s see how things are shaping up for this announcement.

Factors at Play in Q3

In July, Newmont stated that its production will continue to be weighted in the latter half of 2018. The company expects production in the third quarter to improve on the back of increased processing of CC&V concentrates in Nevada along with continued mining at Subika Underground. However, it expressed concerns regarding higher costs, which is expected to increase at KCGM and Long Canyon as well as Boddington with higher stripping.

Rising production cost is a concern for the company. Newmont’s all-in sustaining costs (AISC) rose 16% to $1,024 per ounce in the second quarter, mainly due to higher per unit costs applicable to sales (CAS), higher exploration costs and increased spending on advanced projects. Increased project spending is expected to keep AISC at elevated levels.

The company’s production and cost outlook for 2018 was kept unchanged. Newmont continues to expect attributable gold production in the range of 4.9–5.4 million ounces at AISC of $965-$1,025 per ounce. The company’s CAS outlook for gold is unchanged in the range of $700-$750 per ounce.

Total revenues for the third quarter are projected to increase roughly 8.1% sequentially, as the Zacks Consensus Estimate for revenues is currently pegged at $1,796 million. Notably, the projected figure marks a 4.4% year-over-year decline from $1,879 million in the year-ago quarter.

Newmont expects North America assets to witness solid performance in the second half of 2018. CC&V concentrate shipments to Nevada are projected to increase in the third quarter. Moreover, the Twin Underground and Northwest Exodus projects are complete, which will deliver higher-grade ores at lower cost of production.

In South America, the company expects higher grades at Yanacocha during the second half of 2018 and increasing haul capacity at Merian. In Australia, production at Tanami is likely to be stable. Moreover, it anticipates higher grades at Ahafo surface mines in Africa and Subika Underground ramp-up is expected in the second half of the year.

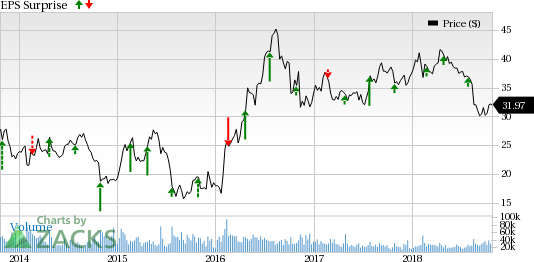

Newmont Mining Corporation Price and EPS Surprise

Newmont Mining Corporation Price and EPS Surprise | Newmont Mining Corporation Quote

Earnings Whispers

Our proven model does not show that Newmont is likely to beat estimates this quarter. That is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below:

Earnings ESP: Earnings ESP for Newmont is -6.25%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are currently pegged at 20 cents and 22 cents, respectively. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Newmont currently carries a Zacks Rank #5 (Strong Sell). Note that we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks Poised to Beat Estimates

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

CF Industries Holdings, Inc. CF has an Earnings ESP of +12.07% and carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Mosaic Company MOS has an Earnings ESP of +2.17% and carries a Zacks Rank #3.

FMC Corporation FMC has an Earnings ESP of +1.09% and carries a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Newmont Mining Corporation (NEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research