High Growth NYSE Stocks

Companies that have significant growth prospects for profitability and returns can add tangible upside to your portfolio. BEST and Eros International are examples of many potential outperformers that analysts are bullish on. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

BEST Inc. (NYSE:BSTI)

BEST Inc. operates as a smart supply chain service provider in the People’s Republic of China. Founded in 2007, and headed by CEO Shao-Ning Chou, the company currently employs 9,998 people and with the company’s market capitalisation at USD $172.31M, we can put it in the small-cap stocks category.

BSTI’s forecasted bottom line growth is an exceptional 93.58%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that BSTI’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 25.00%. BSTI ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Check out its fundamental factors here.

Eros International Plc (NYSE:EROS)

Eros International Plc, together with its subsidiaries, co-produces, acquires, and distributes Indian films in various formats worldwide. Established in 1977, and currently headed by CEO Jyoti Deshpande, the company size now stands at 448 people and with the market cap of USD $776.60M, it falls under the small-cap category.

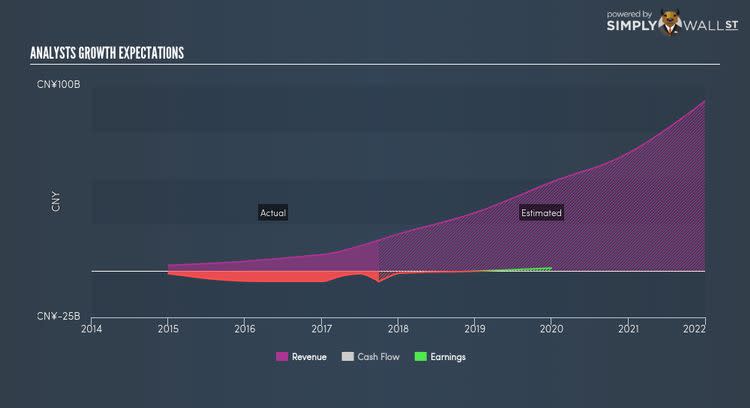

An outstanding doubling of earnings is forecasted for EROS, driven by the underlying 50.60% sales growth over the next few years. It appears that EROS’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 4.12%. EROS ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about EROS? Check out its fundamental factors here.

Carolina Financial Corporation (NASDAQ:CARO)

Carolina Financial Corporation operates as a bank holding company for CresCom Bank that provides a range of commercial and retail banking financial services in South Carolina and North Carolina. Formed in 1996, and currently headed by CEO Jerold Rexroad, the company provides employment to 430 people and has a market cap of USD $775.99M, putting it in the small-cap stocks category.

CARO’s forecasted bottom line growth is an exceptional 95.13%, driven by the underlying 74.02% sales growth over the next few years. It appears that CARO’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 11.09%. CARO ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about CARO? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.