High Growth Stocks To Invest In

Companies that have significant growth prospects for profitability and returns can add tangible upside to your portfolio. Tongda Group Holdings and China Jinmao Holdings Group are examples of many potential outperformers that analysts are bullish on. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

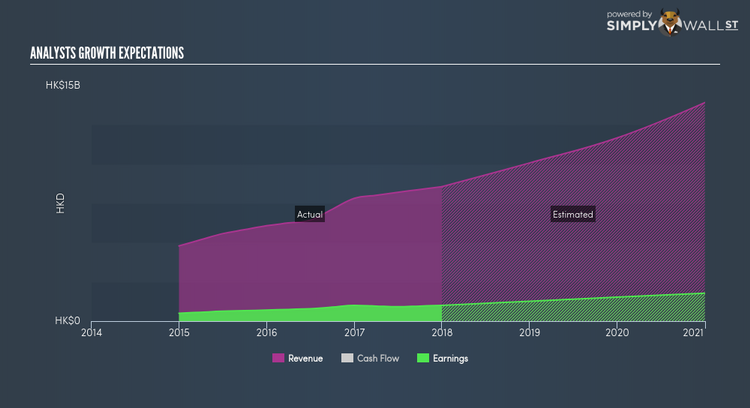

Tongda Group Holdings Limited (SEHK:698)

Tongda Group Holdings Limited, an investment holding company, provides high-precision components used in consumer electronic products in Mainland China, Southeast Asia, the Middle East, and internationally. Founded in 1988, and currently headed by CEO Ya Wang, the company now has 18,000 employees and with the stock’s market cap sitting at HKD HK$9.92B, it comes under the mid-cap group.

698 is expected to deliver an extremely high earnings growth over the next couple of years of 18.48%, driven by a positive double-digit revenue growth of 36.29% and cost-cutting initiatives. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 21.40%. 698’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Want to know more about 698? Check out its fundamental factors here.

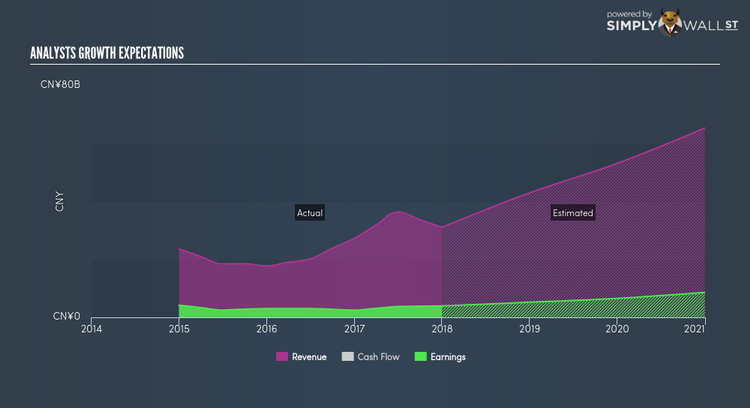

China Jinmao Holdings Group Limited (SEHK:817)

China Jinmao Holdings Group Limited, an investment holding company, invests in, develops, and operates real estate projects in the People’s Republic of China. Started in 2004, and now run by Congrui Li, the company provides employment to 9,149 people and with the stock’s market cap sitting at HKD HK$50.71B, it comes under the large-cap stocks category.

817 is expected to deliver a buoyant earnings growth over the next couple of years of 23.48%, bolstered by an equally impressive revenue growth of 70.99%. It appears that 817’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 18.05%. 817 ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Take a look at its other fundamentals here.

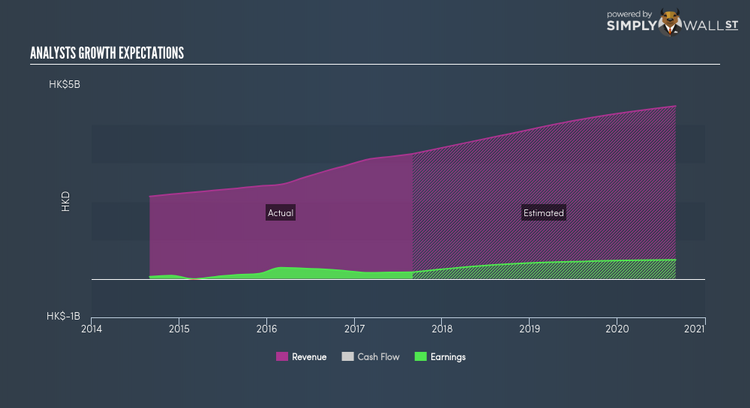

HKBN Ltd. (SEHK:1310)

HKBN Ltd. provides telecommunication services to residential and enterprise markets in Hong Kong. Formed in 1992, and currently run by Chu Kwong Yeung, the company provides employment to 2,888 people and with the stock’s market cap sitting at HKD HK$9.79B, it comes under the mid-cap stocks category.

1310 is expected to deliver an extremely high earnings growth over the next couple of years of 30.52%, driven by a positive double-digit revenue growth of 28.57% and cost-cutting initiatives. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 73.96%. 1310 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Should you add 1310 to your portfolio? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.