High Growth Stocks To Invest In

Investors tend to look for stocks that have a strong future outlook. Why invest in something that will grow slower than the rest of the market? In terms of profitability and returns, stocks such as SiteOne Landscape Supply and comScore are expected to outperform its peers in the future. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

SiteOne Landscape Supply, Inc. (NYSE:SITE)

SiteOne Landscape Supply, Inc., through its subsidiaries, distributes landscape supplies in the United States and Canada. The company size now stands at 3135 people and with the stock’s market cap sitting at USD $2.95B, it comes under the mid-cap category.

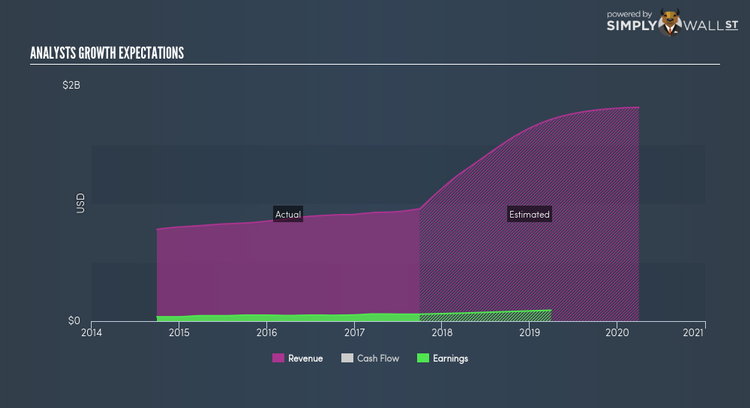

SITE’s forecasted bottom line growth is an exceptional 85.32%, driven by the underlying double-digit sales growth of 18.66% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of SITE, it does not appear extreme. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 27.35%. SITE’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Should you add SITE to your portfolio? I recommend researching its fundamentals here.

comScore, Inc. (OTCPK:SCOR)

comScore, Inc. operates as a cross-platform measurement company that measures audiences, brands, and consumer behavior worldwide. Formed in 1999, and now led by CEO William Livek, the company employs 1,292 people and with the company’s market cap sitting at USD $1.59B, it falls under the small-cap stocks category.

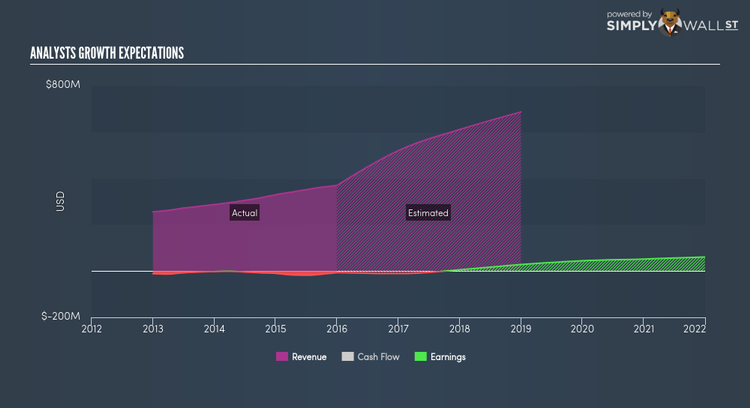

SCOR is expected to deliver an impressive top-line growth of 65.46% over the next couple of years, according to market analysts. Furthermore, the equally impressive growth in operating cash flows indicates that a large portion of this revenue increase is high-quality, day-to-day cash generated by the business, rather than one-offs. The market’s bullish sentiment on SCOR’s capacity to grow at such high rates makes it an interesting stock to dig into deeper. Considering SCOR as a potential investment? Check out its fundamental factors here.

Multi-Color Corporation (NASDAQ:LABL)

Multi-Color Corporation provides various label solutions. Formed in 1916, and run by CEO Vadis Rodato, the company now has 5,450 employees and with the company’s market capitalisation at USD $1.53B, we can put it in the small-cap category.

LABL’s forecasted bottom line growth is an optimistic 38.51%, driven by the underlying 85.08% sales growth over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. Furthermore, the 71.73% growth in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. LABL’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio.

Want to know more about LABL? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.