High Growth Stocks To Profit From

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

Casa Systems, Inc. (NASDAQ:CASA)

Casa Systems, Inc. provides software-centric broadband products in North America, Latin America, the Asia-Pacific, Europe, the Middle East, and Africa. Founded in 2003, and now run by Jerry Guo, the company size now stands at 680 people and with the market cap of USD $1.86B, it falls under the small-cap group.

CASA is expected to deliver an extremely high earnings growth over the next couple of years of 72.08%, driven by a positive double-digit revenue growth of 32.83% and cost-cutting initiatives. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 43.54%. CASA’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Have a browse through its key fundamentals here.

Theravance Biopharma, Inc. (NASDAQ:TBPH)

Theravance Biopharma, Inc., a diversified biopharmaceutical company, discovers, develops, and commercializes human therapeutics. Started in 2013, and currently headed by CEO Rick Winningham, the company provides employment to 340 people and with the company’s market capitalisation at USD $1.34B, we can put it in the small-cap stocks category.

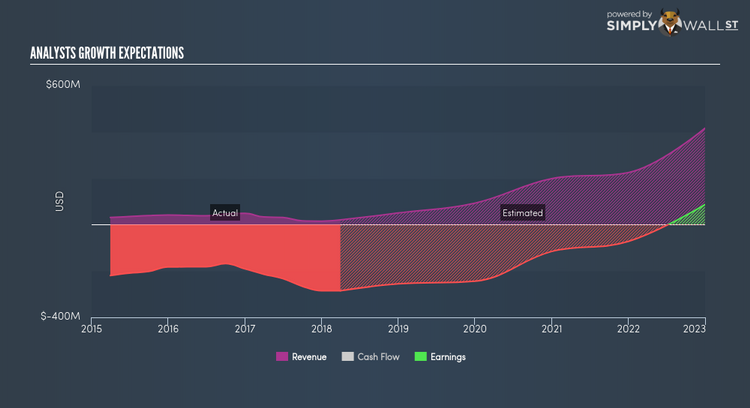

TBPH’s forecasted bottom line growth is an optimistic double-digit 45.46%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that TBPH’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Moreover, the positive 0.97% growth in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. TBPH ticks the boxes for high-growth generation, which makes it an appealing stock to dig into deeper. Interested to learn more about TBPH? Other fundamental factors you should also consider can be found here.

China Lodging Group, Limited (NASDAQ:HTHT)

China Lodging Group, Limited, together with its subsidiaries, develops and operates leased and owned, manachised, and franchised hotels primarily in the People’s Republic of China. Started in 2007, and now led by CEO Min Zhang, the company currently employs 13,525 people and has a market cap of USD $10.61B, putting it in the large-cap category.

HTHT is expected to deliver an extremely high earnings growth over the next couple of years of 27.76%, driven by a positive double-digit revenue growth of 39.96% and cost-cutting initiatives. It appears that HTHT’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 23.95%. HTHT’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Could this stock be your next pick? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.