Highly Undervalued Stocks To Profit From

Undervalued companies, such as Kunming Dianchi Water Treatment and China Star Entertainment, are those that trade at a price below their actual values. Investors can benefit from buying these companies while they are discounted, because they gain when the market prices move towards the stocks’ true values. Below is a list of stocks I’ve compiled that are deemed undervalued based on the latest financial data.

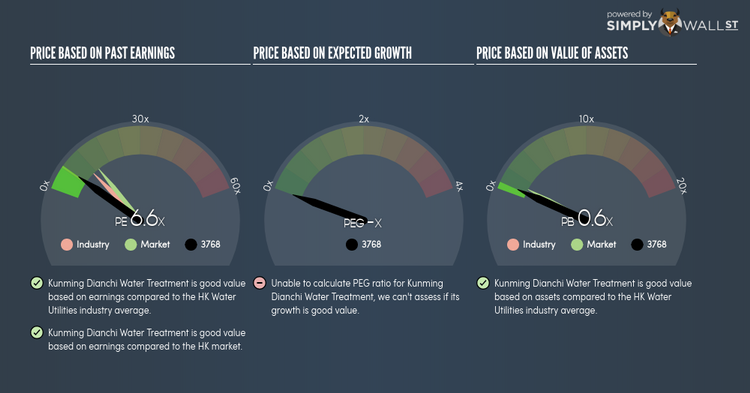

Kunming Dianchi Water Treatment Co., Ltd. (SEHK:3768)

Kunming Dianchi Water Treatment Co., Ltd., together with its subsidiaries, engages in the design, development, construction, operation, and maintenance of water supply and wastewater treatment facilities in the People’s Republic of China. Started in 1989, and now led by CEO Yumei Guo, the company provides employment to 894 people and with the company’s market cap sitting at HKD HK$928.26M, it falls under the small-cap stocks category.

3768’s stock is currently floating at around -60% under its intrinsic level of ¥6.86, at a price tag of HK$2.73, according to my discounted cash flow model. This difference in price and value gives us a chance to buy low. Moreover, 3768’s PE ratio stands at 6.62x against its its Water Utilities peer level of, 10.82x suggesting that relative to its comparable company group, we can invest in 3768 at a lower price. 3768 is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Continue research on Kunming Dianchi Water Treatment here.

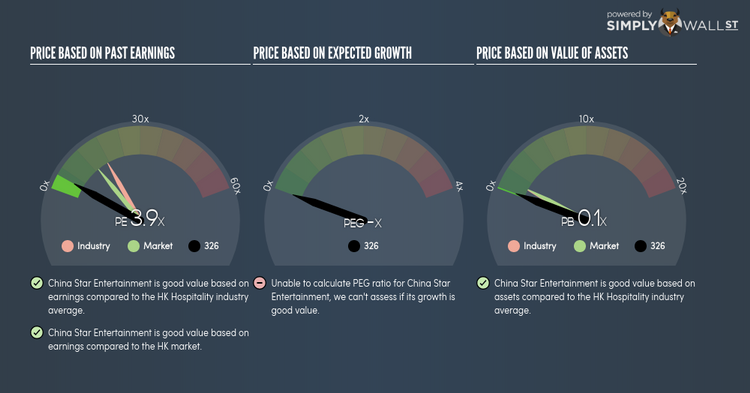

China Star Entertainment Limited (SEHK:326)

China Star Entertainment Limited, an investment holding company, produces and distributes films and television drama series. The company provides employment to 683 people and with the stock’s market cap sitting at HKD HK$429.26M, it comes under the small-cap stocks category.

326’s stock is currently trading at -77% below its real value of $2.05, at the market price of HK$0.47, according to my discounted cash flow model. This discrepancy gives us a chance to invest in 326 at a discount. Moreover, 326’s PE ratio stands at 3.91x while its Hospitality peer level trades at, 17.32x suggesting that relative to its comparable company group, you can buy 326’s shares at a cheaper price. 326 is also a financially healthy company, with near-term assets able to cover upcoming and long-term liabilities. The stock’s debt-to-equity ratio of 5.30% has been diminishing for the last couple of years revealing its capacity to pay down its debt. More on China Star Entertainment here.

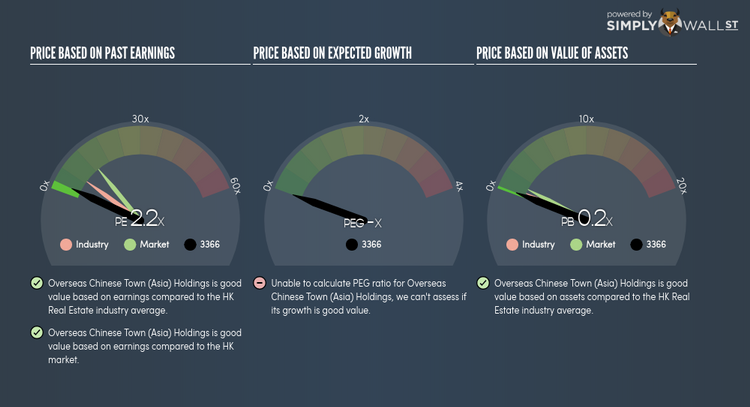

Overseas Chinese Town (Asia) Holdings Limited (SEHK:3366)

Overseas Chinese Town (Asia) Holdings Limited, an investment holding company, develops and operates comprehensive development zone projects in the People’s Republic of China. Founded in 1985, and now led by CEO Mei Xie, the company provides employment to 2,188 people and with the company’s market capitalisation at HKD HK$2.80B, we can put it in the mid-cap stocks category.

3366’s shares are now trading at -83% lower than its actual worth of ¥25.94, at a price of HK$4.29, based on my discounted cash flow model. This difference in price and value gives us a chance to buy low. Furthermore, 3366’s PE ratio is around 2.16x compared to its Real Estate peer level of, 6.92x implying that relative to its comparable company group, 3366 can be bought at a cheaper price right now. 3366 is also a financially healthy company, with current assets covering liabilities in the near term and over the long run. It’s debt-to-equity ratio of 48.04% has been declining over time, indicating its capacity to reduce its debt obligations year on year. Continue research on Overseas Chinese Town (Asia) Holdings here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.