Highwoods (HIW) Q4 FFO & Revenues Top Estimates, NOI Rises

Highwoods Properties, Inc.’s HIW fourth-quarter 2021 funds from operations (FFO) per share of $1.06 surpassed the Zacks Consensus Estimate of 97 cents. Rental and other revenues of $203.2 million outpaced the Zacks Consensus Estimate of $192.7 million.

However, shares of the stock declined marginally, following the earnings release.

Decent leasing activity and improvement in same-property cash net operating income (NOI) growth aided HIW.

While the FFO per share increased 21.8% from 87 cents year over year, the rental and other revenues climbed 12.9% in the fourth quarter.

For 2021, Highwoods reported an FFO per share of $3.86, up 7.8% from the prior year’s $3.58,beating the Zacks Consensus Estimate of $3.85.

Total revenues of $768 million were up 4.2% year over year.

Per management, “We delivered strong financial and operating results in the fourth quarter and for the full year. Fourth quarter FFO was the highest in our history, and we were above the high-end of our upwardly revised full year outlook even when excluding land sale gains.”

Quarter in Detail

Highwoods leased 884,000 square feet of second-generation office space in the fourth quarter, including 284,000 square feet of new leases. The average in-place office cash rent was up 5% per square foot on a year-over-year basis. At the end of the reported quarter, in-service occupancy was 91.2%.

Excluding the net impact of temporary rent deferral repayments, the same-property cash NOI increased 3.2% year over year.

As of Dec 31, 2021, Highwoods had $23.1 million of cash and cash equivalents compared with the $109.3 million reported as of Dec 31, 2020.

Guidance

Highwoods predicts 2022 FFO per share of $3.76-$3.2. The Zacks Consensus Estimate for the same is pegged at $3.85.

The same-property cash NOI for the current year is projected at 0-2%, while the year-end occupancy is estimated to be 90.5-92.5%. Dispositions are expected to be $150-$200 million.

Highwoods currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

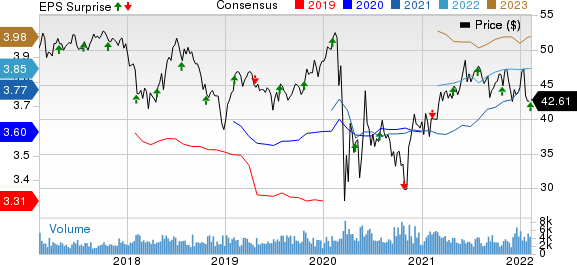

Highwoods Properties, Inc. Price, Consensus and EPS Surprise

Highwoods Properties, Inc. price-consensus-eps-surprise-chart | Highwoods Properties, Inc. Quote

Performance of Other REITs

Alexandria Real Estate Equities, Inc. ARE reported an adjusted FFO of $1.97 per share for fourth-quarter 2021, up 7.1% from the year-ago quarter’s $1.84. The figure surpassed the Zacks Consensus Estimate of $1.96.

The year-over-year improvement in ARE’s FFO resulted from 24.4% top-line growth to $576.9 million. Results reflected decent internal growth. Alexandria witnessed a continued healthy leasing activity and rental rate growth during the quarter.

Mid-America Apartment Communities, Inc. MAA, commonly referred to as MAA, reported fourth-quarter 2021 core FFO per share of $1.90, surpassing the Zacks Consensus Estimate of $1.87. The reported number increased 15.2% from the year-ago figure of $1.57.

MAA’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. The average physical occupancy for the same-store portfolio also increased year over year.

Equity Residential’s EQR fourth-quarter 2021 normalized FFO per share of 82 cents outpaced the Zacks Consensus Estimate of 80 cents. Rental income of $645.1 million also beat the consensus mark of $628.6 million.

On a year-over-year basis, Equity Residential’s normalized FFO per share improved 7.9%, while rental income rose 5.2%. EQR’s results were driven by a strong physical occupancy, a substantial improvement in pricing power and an increase in non-Residential revenues.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equity Residential (EQR) : Free Stock Analysis Report

Highwoods Properties, Inc. (HIW) : Free Stock Analysis Report

MidAmerica Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research