Hilltop Holdings (HTH) Q2 Earnings Beat Estimates, Stock Up

Hilltop Holdings Inc.’s HTH shares appreciated 2.3%, as the company’s second-quarter 2020 earnings of $1.08 per share beat the Zacks Consensus Estimate of 45 cents. Also, the bottom line compares favorably with the prior-year quarter’s earnings of 64 cents.

Results reflect an improvement in revenues aided by growth in non-interest income and a strong balance-sheet position. However, declining net interest income and higher provisions were major headwinds.

Net income applicable to common stockholders was $128.5 million, up significantly from the prior-year quarter.

Revenues Improve, Costs Flare Up

Net revenues came in at $572.7 million, increasing 49% year over year.

Net interest income was $104.6 million, down 2.5% from the prior-year quarter. Net interest margin (taxable equivalent basis) came in at 2.81%, contracting 68 basis points (bps) from the prior-year quarter.

Non-interest income jumped 69.1% from the year-ago quarter to $468.1 million. This was largely driven by a rise in all fee income components, except securities commissions and fees.

Non-interest expenses flared up 21.7% from the year-ago quarter to $370.2 million. This upswing mainly resulted from rise in employees' compensation and benefits costs.

Credit Quality Worsens

Provision for loan losses was $66 million compared with the reversal of credit losses of $672,000 in the prior-year quarter. The company built a significant reserve amid the pandemic-related economic uncertainty.

Non-performing assets as a percentage of total assets were 0.56%, up 19 bps. Also, non-performing loans were $68.3 million as of Jun 30, 2020, up significantly from the $32 million recorded in the comparable period of 2019.

Strong Balance Sheet

As of Jun 30, 2020, Hilltop Holdings’ cash and due from banks was $1.7 billion, up significantly from the prior quarter. Total shareholders’ equity was $2.3 billion, up 6% sequentially.

As of Jun 30, 2020, net loans held for investment increased 6.3% sequentially to $7.7 billion. Moreover, total deposits were $11.6 billion, up 17.2% from the prior quarter.

Profitability & Capital Ratio Improve

Return on average assets at the end of the reported quarter was 3.30%, up from the prior-year quarter’s 1.74%. Also, return on average equity was 23.32%, up from the year-earlier quarter’s 11.63%.

Common equity tier 1 capital ratio was 18.46% as of Jun 30, 2020, up from 16.32% in the corresponding period of 2019. Moreover, total capital ratio was 21.82%, reflecting a fall from the prior-year quarter’s 17.14%.

Our Take

Hilltop Holdings’ top-line growth is anticipated to remain decent, supported by modest loan demand. While higher costs, low interest rates and the pandemic-induced slowdown are major near-term concerns, its strong balance sheet will likely keep supporting financials.

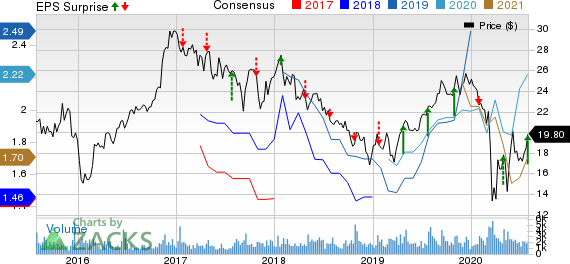

Hilltop Holdings Inc. Price, Consensus and EPS Surprise

Hilltop Holdings Inc. price-consensus-eps-surprise-chart | Hilltop Holdings Inc. Quote

Hilltop Holdings currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Zions Bancorporation’s ZION second-quarter net earnings per share of 34 cents missed the Zacks Consensus Estimate of 37 cents. Moreover, the bottom line compared unfavorably with the year-ago quarter’s 99 cents.

Washington Federal’s WAFD third-quarter fiscal 2020 (ended Jun 30) earnings were 46 cents per share, missing the Zacks Consensus Estimate by a penny. The figure also declined 31.3% year over year.

Associated Banc-Corp’s ASB second-quarter 2020 adjusted earnings of 26 cents per share came in line with the Zacks Consensus Estimate. The bottom-line figure, nevertheless, slumped 49% year over year. Earnings excluded gain on the sale of Associated Benefits and Risk Consulting in the reported quarter.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilltop Holdings Inc. (HTH) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Washington Federal, Inc. (WAFD) : Free Stock Analysis Report

Associated BancCorp (ASB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research