HMS Holdings (HMSY) Loses 2.9% Since Q2 Earnings Release

HMS Holdings Corp’s HMSY share price has declined 2.9% as of Aug 12 since the company reported weaker-than-expected results on Aug 7.

The company reported adjusted earnings per share (EPS) of 19 cents for second-quarter 2020, in line with the Zacks Consensus Estimate. However, the bottom line fell 44.1% from the year-ago quarter.

Revenues of $142.7 million missed the Zacks Consensus Estimate by 7.4%. Also, the top line dropped 15.2% on a year-over-year basis.

Q2 Segmental Analysis by Product

Payment Integrity (“PI”) revenues amounted to $24.4 million, down 50.3% year over year.

Population Health Management (“PHM”) revenues totaled $11.5 million in the quarter under review, down 17.6% on a year-over-year basis.

Revenues at the Coordination of Benefits (“COB”) segment amounted to $106.7 million in the second quarter, up 1.6% year over year.Organic COB revenues, excluding Accent, fell 8.8% owing to lower claim volumes resulting from the impact of the COVID-19 pandemic.

Margin Analysis

Gross profit came in at $32.4 million, down 52.8% from the prior-year quarter. Gross margin was 22.7% of net revenues, down 1807 basis points (bps) year over year.

Operating profit in the second quarter was $5.6 million, down 86.1% from the year-ago quarter. Operating margin was 3.9%, down 2017 bps from the prior-year quarter.

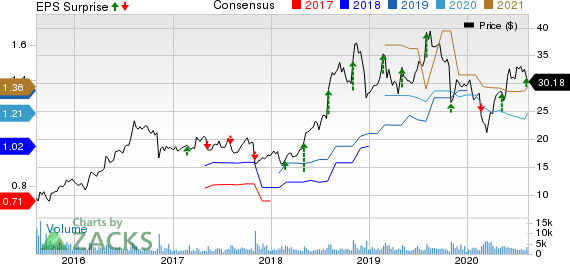

HMS Holdings Corp Price, Consensus and EPS Surprise

HMS Holdings Corp price-consensus-eps-surprise-chart | HMS Holdings Corp Quote

Financial Update

The company exited the second quarter with cash and cash equivalents of $193.1, up from $148 million at the end of first quarter.

Cumulative net cash provided by operating activities at the end of the second quarter came in at $65.8 million, compared with $78.1 million in the year-ago period.

2020 Guidance Updated

The company has revised its 2020 guidance.

For 2020, the company anticipates revenues between $680 million and $690 million, indicating growth of 10.5-12.1% from the year-ago figure. The Zacks Consensus Estimate for the same is pegged at $681.8 million.

Net income is expected in the band of $66-$74 million. The range reflects a decline of 4.3% to an increase of 7.2% from the year-ago period.

Summing Up

HMS Holdings ended second-quarter 2020 on a mixed note. The company witnessed revenue growth within its COB segment during the quarter. A strong 2020 outlook also instills investor optimism in the stock.

However, the decline in PI and PHM revenues is concerning. Cut-throat competition in the U.S. medical cost-containment space remains a dampener. Moreover, the company witnessed contraction in both gross and operating margins in the quarter under review.

Nonetheless, despite the recent challenges, the company is well positioned to deliver value to its clients, while its business outlook for the second half of 2020 remains positive.

Zacks Rank and Key Picks

HMS Holdings currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are Thermo Fisher Scientific Inc. TMO, PerkinElmer, Inc. PKI and OPKO Health, Inc. OPK. While PerkinElmer sports a Zacks Rank #1 (Strong Buy), the other two carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher reported second-quarter 2020 adjusted EPS of $3.89, beating the Zacks Consensus Estimate by 45.7%. Revenues of $6.92 billion outpaced the consensus mark by 0.1%.

PerkinElmer reported second-quarter 2020 adjusted EPS of $1.57, surpassing the Zacks Consensus Estimate by 68.8%. Revenues of $811.7 million outpaced the consensus mark by 1.3%.

OPKO Health reported second-quarter 2020 EPS of 5 cents against the Zacks Consensus Estimate of a loss of 7 cents per share. Revenues of $301.2 million surpassed the consensus estimate by 28.4%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

HMS Holdings Corp (HMSY) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research