Home Depot's Comparable Sales Surge Again

- By Nathan Parsh

Earlier this month, The Home Depot Inc. (NYSE:HD) reported third quarter earnings results that easily beat Wall Street analysts' expectations. Yet, shares of the company are down somewhat since the earnings release, while the S&P 500 has shown a slight gain.

Home Depot's stock is not cheap, but it doesn't trade too far off of its intrinsic value, in my opinion. This could give investors building a position in the name a chance to add shares at a fair price.

Quarterly highlights

Home Depot announced earnings results for the third quarter on Nov. 17. Earnings per share grew 65 cents, or 26%, year-over-year to $3.18, which was 15 cents better than analysts' estimates. Net earnings grew 24% to $3.4 billion. Revenue grew 23.2% to $33.5 billion, which was $1.7 billion above analysts' predictions.

Same-store sales grew 24.1%, which was much higher than already-elevated estimates of 16.9%. This was an acceleration from the second quarter. U.S. comparable sales were even better at 24.6%. All 40 of Home Depot's markets were up double-digits. Mexico had its best quarter since the Covid-19 pandemic began and same-store sales in Canada were above the company's average. Year-to-date, net sales are $15 billion more than the same period a year ago. Five net store additions gives Home Depot a store count of 2,295.

Home Depot is benefiting from the combination of higher transactions and a growing customer basket size. Total transactions grew 13% year-over-year to more than 453 million, with the average ticket price increasing 10% to almost $73.

Sales per retail square foot were higher by 23.1% to $552.85 as Home Depot is seeing growth in many different departments. E-commerce continues to be a real source of strength for the company as sales through this channel surged 80% from the previous year. Approximately 60% of orders were filled at a physical store location.

Growth was broad-based throughout the store, even in areas with significant commodity inflation. For example, despite a 130% increase in the price of lumber from the same period a year before, demand for the product was very high. Overall, commodity inflation added 260 basis points to average ticket growth as Home Depot was able to pass rising costs on to the consumer without sacrificing volumes. While gardening is often a major source of revenue during the spring and summer months, comparable sales were still above 20% when excluding this category. This demonstrates just how robust business was throughout the store.

Do-it-yourself and professional customers both posted double-digit sales gains, with the latter producing its best quarter of the year. Customers also didn't shy away from big ticket items as sales for products costing more than $1,000 grew 23%.

There were some minor areas of concern in the quarter. First, gross margins declined 30 basis points to 34.2% while the operating margin declined 10 basis points to 14.5%. Some of this is likely tied to the company's investments in its workforce. The company has spent $1.7 billion on Covid-19 related costs through the end of the third quarter. Home Depot stated that it plans to shift approximately $1 billion of these costs into permanent compensation for its frontline hourly employees. This will impact margins going forward, but I am not terribly concerned about this. Companies taking care of their employees have been shown to reduce replacement costs, improve team morale and lead to better results overall. As a long-term investor, I think this is a good decision.

Merchandise inventory rose 2.8% to $16.2 billion, but this isn't that large of a number to cause me concern. The company has shown over the last few quarters that sales are grown at a high rate and probably will for the duration of the pandemic. With many industries still operating on a work-from-home format, people continue to update their homes. Lower mortgage interest rates are also a positive for Home Depot as customers will likely look to update their homes before selling or after buying. The increase in inventory is likely a positive if demand remains heightened.

Turning to the balance sheet, Home Depot ended the quarter with $34.5 billion of total current assets, which includes $14.7 billion in cash and cash equivalents. This compares favorably to total current liabilities of $25.4 billion. The company has no short-term debt, but does carry $32.8 billion of long-term debt.

The company also distributed $1.6 billion of dividends during the quarter, which consumed ~76% of its free cash flow. This is higher than the average free cash flow payout ratio of 46% since 2017.

Home Depot also agreed to purchase HD Supply Holdings (NASDAQ:HDS), which is a national distributor of maintenance, repair and operations products, on Nov. 16 for $56 per share in cash and new debt. The total value of the deal will approach $8 billion. The deal is expected to close by the end of January 2021. The addition of HD Supply will help Home Depot capture more of the very fragmented maintenance, repair and operations market. Leadership expects the deal to be accretive starting next fiscal year.

Analysts surveyed by Yahoo Finance expect Home Depot to earn $11.81 per share this year, which would be a 15.2% increase from last year's result. This is just above the company's five-year average EPS growth rate of 14%.

Using Friday's closing price of $276, Home Depot trades with a forward price-earnings ratio of 23.4. This is still higher than the five-year average price-earnings ratio of 20.7, but it is a better valuation then the last time I looked at the stock.

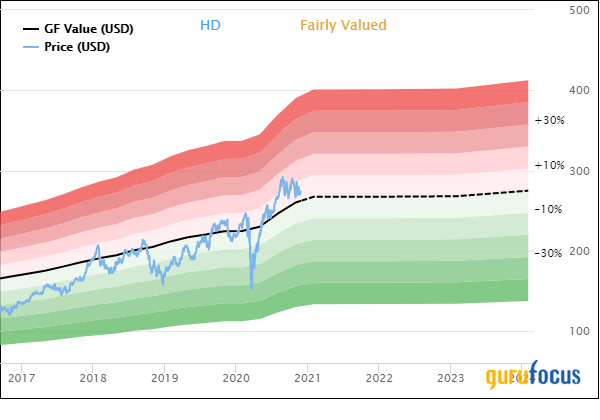

The GuruFocus Value chart believes shares to be fairly valued, according to the chart below:

The stock's GF Value is $262.37, which results in a price-to-GF-Value of 1.05 using the most recent closing price.

Final thoughts

Home Depot had another monster quarter with comparable sales easily beating expectations. All regions saw growth and gains were seen throughout the store. The pandemic has helped results, but so too as have low interest rates. With both factors likely to continue in the near-term, Home Depot should continue to benefit.

At the same time, Home Depot has a lower EPS multiple today then it did three months ago and the stock's current price is only 5% above its GF Value.

With all the positives going for the company, I don't mind paying above Home Depot's intrinsic value. I will likely be adding to this position in the stock early next week.

Author disclosure: the author maintains a long position in Home Depot.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.