Homebuilders ETFs Rise Despite Housing Data

Wall Street got off to a relatively strong start this week, though investors kept their focus primarily on the Federal Reserve’s two-day policy meeting. In other economic news, the housing industry came into focus as hombuilder sentiment, building permits and housing starts were reported. The NAHB/Wells Fargo homebuilder sentiment index soared to 52 in June, marking the first reading above 50 since April 2006 and the biggest jump since 2002. Building permits and housing starts data, however, were somewhat underwhelming [see The Cheapest ETF for Every Investment Objective].

Building Permits and Housing Starts Miss the Mark

The Census Bureau reported that building permits came in at 0.97 million permits for the month of May, slightly below analysts’ expectations of 0.98 million permits. In the previous recording, building permits came in well above expectations, with the metric coming in at 1.02 million compared to the forecasted 0.94 million.

Yesterday’s housing starts data also came in below expectations, with only 0.91 million new residential buildings beginning construction in the month of May. Analysts had expected housing starts to come in at 0.95 million. In April, housing starts also came in below expectations, at 0.85 million [see also Sector ETFs: Biggest Winners & Losers YTD].

Below, we highlight the trailing six-month building permits and housing data (note that the units are in millions):

Homebuilding ETFs Performance Recap

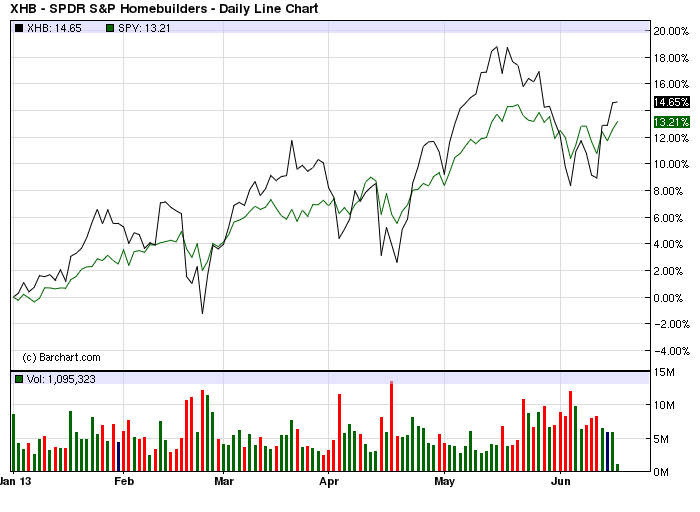

Though there have been some hits and misses on the housing data front, overall the industry has showed tremendous strength in recent years. As such, building and construction ETFs have fared quite well. Year-to-date, the SPDR Homebuilders ETF (XHB, A+), the largest fund covering this sector, has gained over 14%, and over the trailing 26-week period it has climbed 19.2%.

Click To Enlarge

Follow me on Twitter @DPylypczak.

[For more ETF analysis, make sure to sign up for our free ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: XHB Pops On Homebuilder Data, EWG Jumps On Bundesbank Outlook

ETFdb Weekly Watchlist: XHB, TLT, XLI Hinge On Housing, Durable Goods And Bernanke

ETFdb Weekly Watchlist: XRT, EWG, XHB Hinge On Retail, Sentiment And Housing Data