The Hope Education Group (HKG:1765) Share Price Is Down 29% So Some Shareholders Are Getting Worried

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Hope Education Group Co., Ltd. (HKG:1765) share price is down 29% in the last year. That's well bellow the market return of -6.5%. Hope Education Group hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. There was little comfort for shareholders in the last week as the price declined a further 4.1%.

See our latest analysis for Hope Education Group

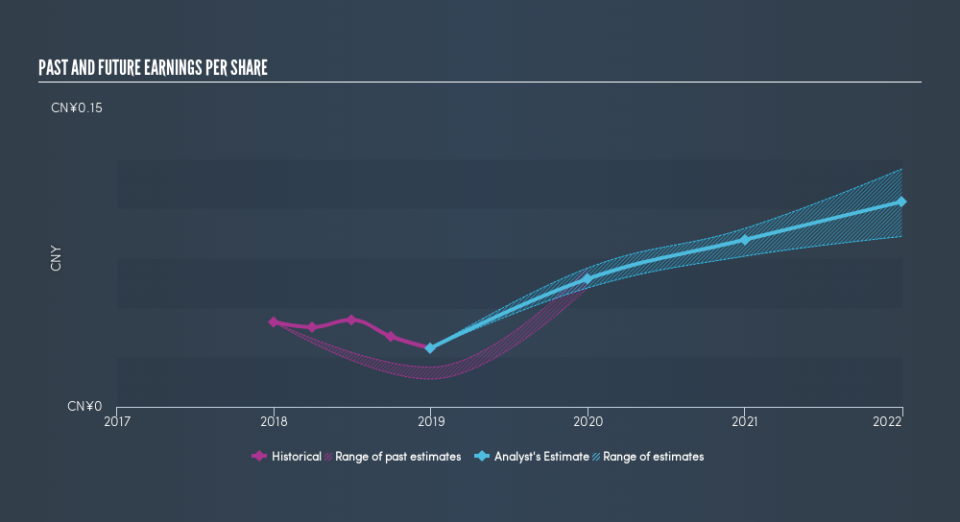

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Hope Education Group had to report a 31% decline in EPS over the last year. We note that the 29% share price drop is very close to the EPS drop. So it seems that the market sentiment has not changed much, despite the weak results. Instead, the change in the share price seems to reduction in earnings per share, alone.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Hope Education Group has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Hope Education Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Hope Education Group shareholders are happy with the loss of 28% over twelve months (even including dividends). That falls short of the market, which lost 6.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 8.4% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before deciding if you like the current share price, check how Hope Education Group scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.